Student-Entrepreneur Status: Launching a Startup While on a French Study Visa

Turning Your Class Project Into a Real Company

France is becoming one of Europe’s most dynamic startup hubs, and the government actively encourages young founders. If you are already in France on a study visa and you are itching to commercialize a side project, the Student-Entrepreneur Status (Statut National d’Étudiant-Entrepreneur or SNEE) may be the launchpad you need. Below we unpack how the scheme works, which residence rules apply, and the practical steps to go from lecture hall to seed round without jeopardizing your legal stay.

1. Student-Entrepreneur Status in a Nutshell

- Created in 2014 and managed by the PEPITE network (Pôles Étudiants pour l’Innovation, le Transfert et l’Entrepreneuriat).

- Open to any student enrolled in a French institution or any graduate who finished a French degree less than 3 years ago, regardless of nationality.

- Gives access to an incubator, mentoring, coworking space, and sometimes seed-fund competitions.

- Comes with the D2E diploma (Diplôme Étudiant-Entrepreneur) that can replace ECTS credits or an internship.

Important: SNEE is an educational status, not an immigration category. You still need a valid residence permit that allows you to stay and, if relevant, work.

2. Why It Matters for Non-EU Students

- Keep your study visa – You remain under the same residence permit (usually “VLS-TS étudiant”).

- Freedom to bill clients – Entrepreneurial income is not subject to the 964-hour cap that limits salaried work for students.

- A bridge toward a work or talent permit – Prefectures treat SNEE participation as a positive indicator when you later apply for a “Passeport Talent – Création d’entreprise” or a standard work permit.

- French social protection – You continue to benefit from student social security and, in most cases, reduced cotisation rates.

3. Are You Eligible?

- Hold a valid French student residence permit.

- Be enrolled in a French university or grande école or hold a diploma dated within the last 36 months.

- Present a genuine entrepreneurial project (innovation not mandatory, but viability is assessed).

- Have at least an A2 level in French if most operations will be in French; English-only projects are accepted in several PEPITEs.

4. Step-by-Step Application Guide

- Draft a concise business plan – 5-10 pages covering problem, solution, market, team, and financials.

- Register online on the official PEPITE platform (typically between May and September). Attach your passport, residence permit scan, transcript, and the plan.

- Pitch in front of a jury – A mix of professors, incubator managers, and local entrepreneurs. Questions focus on feasibility, not just innovation.

- Receive an admission letter – Keep it safe; you will show this to the prefecture if asked.

- Sign up for the D2E diploma via your university’s continuing education service. Tuition ranges from €0 to €500, often covered by the region.

- Open your company – Most foreign students pick the micro-entrepreneur regime for simplicity, but SASU or SARL may be better for fund-raising (see Section 6).

Tip: Some prefectures still ask for a convention de stage to authorize entrepreneurial activity. Politely remind them that Circular No. 2015-0012 confirmed SNEE holders can replace internships with the entrepreneurial project.

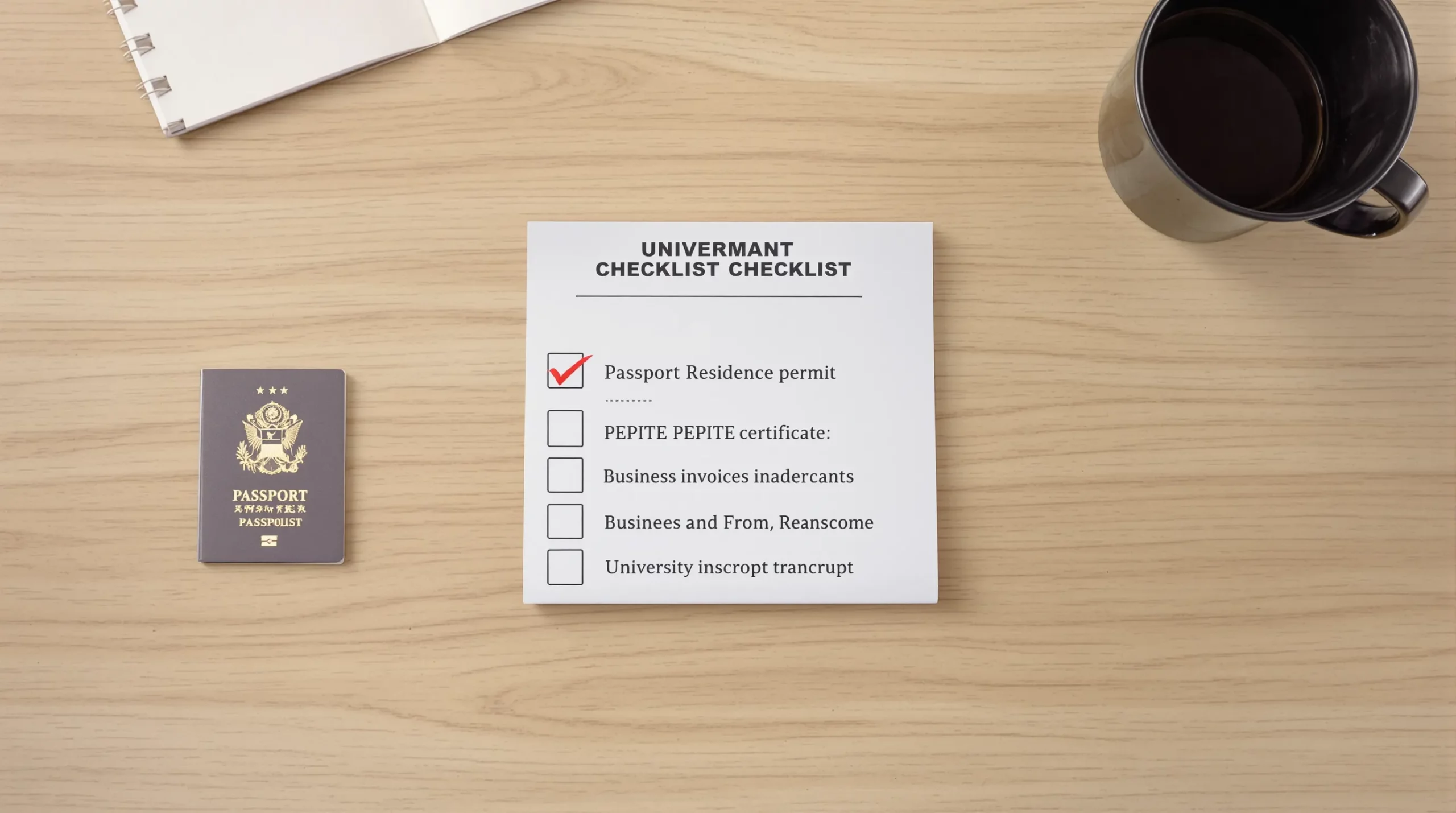

5. Immigration Compliance Checklist

- Notify the prefecture: While not always mandatory, sending a registered letter with your PEPITE admission certificate shows transparency.

- Track your revenue: Exceeding the French minimum wage for more than 12 months may trigger a switch to a business-related permit during renewal.

- Health insurance: If you graduate and lose student status but keep SNEE (within the 3-year window), register with CPAM as an auto-entrepreneur.

- Visa renewal: Prepare a file showing academic progress and entrepreneurial milestones (prototype, first clients, incubator letters). ImmiFrance can review your dossier before the prefecture appointment.

For deeper rules, Service-Public.fr lists the relevant CESEDA articles (L422-5 and R522-1).

6. Choosing the Right Legal Structure

- Micro-entrepreneur

- Max revenue: €77 700 for services (2025 ceiling).

- Real-time tax payment; no corporate tax return.

- Perfect for freelancing, small e-commerce, or MVP testing.

- SASU (single-shareholder corporation)

- Separate legal personality and limited liability.

- Attractive for investors; flexible bylaws.

- Higher setup costs (about €350 for registration + legal ads).

- EURL/SARL

- Good if two or more co-founders want strong social coverage under the general scheme.

Non-EU founders must attach a copy of their valid residence permit when filing with the Guichet Unique INPI. Expect a processing time of 48-72 hours.

7. Taxes and Social Charges as a Foreign Student-Founder

- Income tax: Opt for the “prélèvement libératoire” under micro-entrepreneur to pay a flat 2.2 % on turnover, or file annually with other income.

- Social contributions: About 21 % of turnover in micro-entrepreneur mode; variable if you draw a salary from a SASU.

- TVA (VAT): Exemption up to €36 800 in services; mandatory declaration once you pass the threshold.

8. After Graduation: Staying in France to Scale

Scenario 1 – Jeune diplômé (APS): If you are finishing a master’s, you can request the 12-month “Autorisation Provisoire de Séjour” to continue working on the startup while looking for funding or a salaried contract.

Scenario 2 – Passeport Talent – Créateur d’entreprise: Requires a business plan proving €30 000 in investment and a salary equal to France’s minimum wage. SNEE experience often shortens the prefecture review because market validation has begun.

Scenario 3 – Change of status to Profession Libérale: Viable for service activities that do not need large capital (consulting, design, IT). Show at least the French minimum wage in projected net income.

ImmiFrance accompanies founders in all three transitions, including drafting the financial forecasts and coaching for the prefecture interview.

9. Common Pitfalls to Avoid

- Ignoring intellectual property: File a trademark on INPI before demo days; foreign founders enjoy the same protection.

- Mixing salaried work and entrepreneurship without limits: The 964-hour cap still applies to salaried hours, even if you are also an entrepreneur.

- Late tax registration: Micro-entrepreneurs must declare turnover monthly or quarterly from day one, even if zero.

- Staying silent at renewal: Prefectures dislike surprises. Bring updated financial statements and invoices.

10. Mini Case Study: From Campus App to VC Backing

Lina, a Colombian master’s student at Université Paris-Cité, joined PEPITE Sorbonne in 2023 to build a campus-wide meal-sharing app. She started as a micro-entrepreneur, invoiced €18 000 in her first year, and kept within her student visa. Upon graduation, she switched to the Passeport Talent creator track with help from ImmiFrance, raised €300 000 from a Paris seed fund, and now employs three interns. Key to her success: an organized prefecture file and early IP filings.

Frequently Asked Questions (FAQ)

Can I collect a salary from my own company while on a student visa? Yes, but any salaried income from your company still counts toward the annual 964-hour work limit. Dividends or micro-entrepreneur revenue do not.

Do I need French co-founders to register a company? No. French law allows 100 % foreign shareholding. You only need a French address for the registered office.

Will the prefecture refuse my visa renewal if my startup is not profitable yet? Unlikely if you can show serious progress: prototype, PEPITE reports, mentorship letters, or letters of intent from clients. Profitability is not legally required at student stage.

Can I keep my CAF housing aid once I start billing clients? Usually yes. Report your monthly revenue on the CAF portal; aid is adjusted automatically.

Is SNEE compatible with an apprenticeship contract? In most regions it is, but your employer must agree on part-time hours so you can meet incubator commitments.

Ready to turn that classroom idea into a French legal entity? The immigration lawyers and business advisors at ImmiFrance have already secured over 500 student-founder visas and permit renewals. Book a free 15-minute assessment to verify your eligibility and get a custom action plan.