Employer Sanctions for Hiring Undocumented Workers in 2025: What to Know

Hiring in France in 2025? Make Sure Your Workforce Is 100 % Compliant

Since 1 January 2025, the French government has tightened controls on undocumented labour as part of the new Immigration & Integration Act (Loi n° 2024-1555). Prefectural labour inspectors have doubled their workplace checks, and the maximum administrative fine has gone up by 25 %.

If you are an employer in France—or a foreign national thinking of accepting work without the right papers—understanding the latest rules is essential. Below we break down the legal basis, the sanctions that now apply, and the steps every company should take to avoid costly penalties.

1. The Legal Framework in 2025

- CESEDA, Articles L. 8251-1 to L. 8256-3: core provisions prohibiting employment of foreign nationals without a valid work authorisation or residence permit.

- Labour Code, Article L. 1221-10: employer obligation to check and file the employee’s permit at least 48 hours before the start date.

- Decree of 14 February 2025: updated fine amounts and introduces mandatory e-verification via the new "Contrôle Travail" portal.

Key change for 2025: uploading a copy of the residence permit on the "Contrôle Travail" portal is now compulsory for all contracts, including seasonal and interim positions.

2. Administrative Sanctions

| Type of Sanction | 2024 Amount | 2025 Amount | Trigger |

|---|---|---|---|

| Administrative fine per undocumented worker | €15,000 | €18,750 | First offence |

| Temporary closure of establishment | Up to 3 months | Up to 6 months | Repeated offence within 5 years |

| Refund of public subsidies | 12 months | 24 months | Receipt of EU/French grants in last 2 years |

The prefect can also impose an “employer contribution” covering the foreigner’s repatriation costs if an OQTF (Obligation de Quitter le Territoire Français) is issued.

3. Criminal Penalties

Hiring at least two undocumented workers (or one minor) turns the offence into a crime under CESEDA L. 8256-2:

- Fine of €100,000 per worker for companies; €45,000 for individuals.

- Up to 5 years’ imprisonment for company directors.

- Additional penalties: prohibition to bid on public contracts, confiscation of equipment, publication of the judgment.

4. Civil Liability and Back Payments

Besides fines, employers are liable for:

- Unpaid wages (based on collective agreement minimums) backdated to the start of illegal employment.

- Social security contributions (+ late penalties and surcharges).

- Damages for workplace accidents not covered by insurance because of illegal status.

5. The New “Extended Liability” for Principal Contractors

If you subcontract any part of your activity, the 2025 Act now applies a presumption of liability when a subcontractor is caught with undocumented labour. The principal risk:

- Joint payment of administrative fines and back wages.

- Termination of public contracts without compensation.

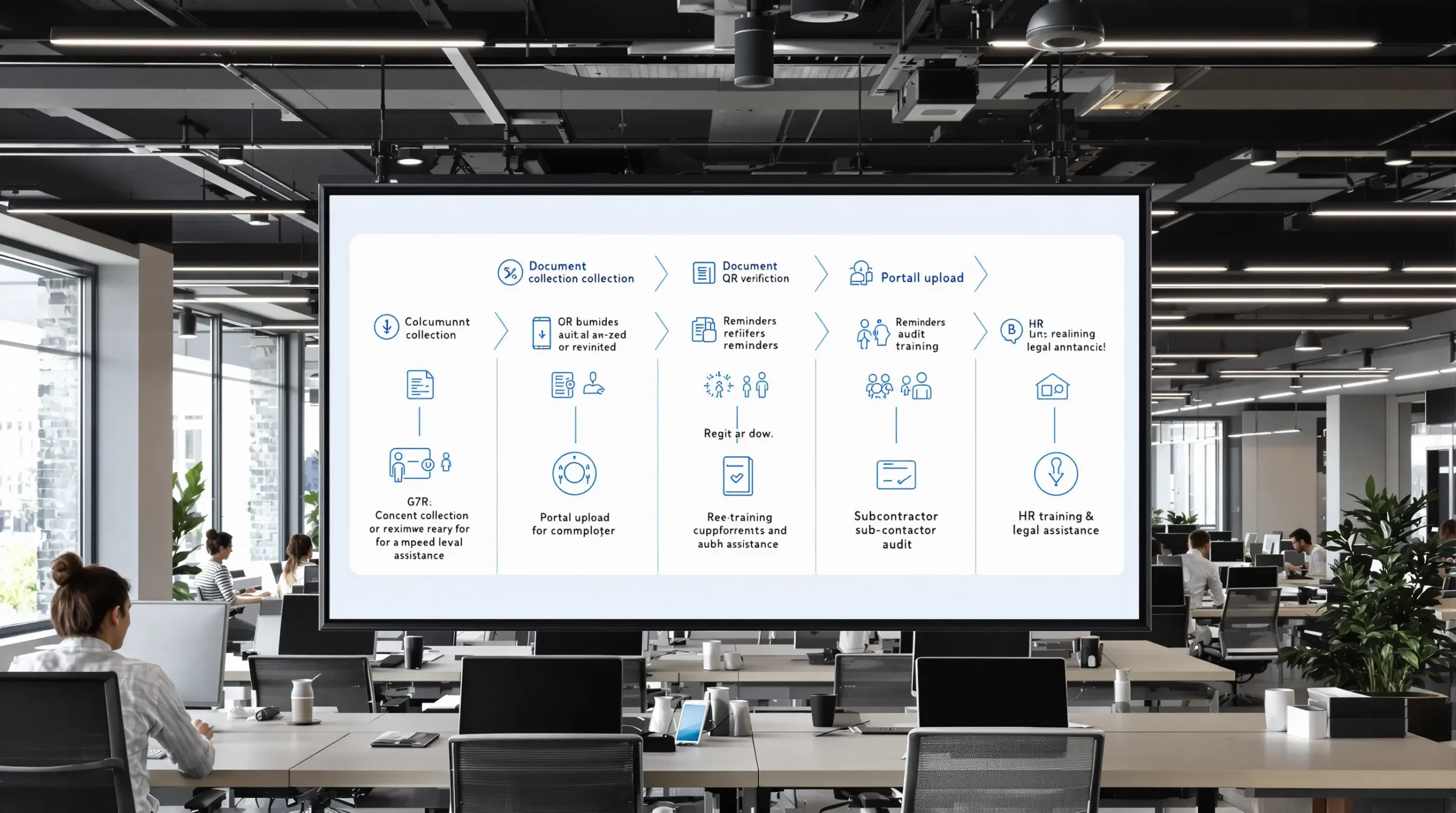

6. Seven-Step Compliance Checklist for 2025

- Collect original documents: residence permit and, where required, the new digital work authorisation certificate (PDF with QR code).

- Verify authenticity: use the QR code or the free "France-Auth" mobile app issued by the Interior Ministry.

- File on Contrôle Travail: upload copies and receive the acknowledgment (« accusé de vérification »). Keep it 5 years.

- Calendar reminders: flag permit expiration dates 4 months in advance.

- Audit subcontractors: contractually require quarterly evidence of compliance.

- Train HR staff: annual refresher on document fraud trends and CESEDA changes.

- Seek professional help: for borderline cases (expired permits, pending renewals), get legal advice before day one of employment.

7. What If You Discover an Undocumented Employee?

Act quickly but follow due process:

- Suspend the contract (mise à pied conservatoire) pending verification. This avoids “concealed work” allegations.

- Invite the worker to regularise their status. They may qualify for a temporary work permit or one of the 2024 “skills and shortages” regularisation schemes.

- Notify authorities only if the employee cannot secure valid papers. Reporting protects the employer from further fines but must respect GDPR and labour-law procedures.

8. Regularisation Options for the Employee (2025)

Undocumented workers who meet certain criteria can apply for a residence permit without leaving France. The main pathways are:

- “Talent – Professions en tension” permit: at least 12 months’ work in a shortage occupation such as caregiving, construction, or hospitality.

- Private and family life (Vie privée et familiale): long-term French partner or school-age children in France.

- Humanitarian grounds: medical conditions verified by OFII.

ImmiFrance offers step-by-step assistance, including prefecture appointment booking and dossier preparation. Learn more about our residence permit assistance.

Frequently Asked Questions (FAQ)

Do I still have to notify the prefecture by registered letter?

No. Since February 2025, electronic filing via Contrôle Travail replaces the letter. You receive a digital receipt valid during an inspection.

My employee’s card expires next week and the prefecture appointment is only next month. Can I keep them on payroll?

Yes, if you hold the récépissé (renewal receipt) or the new "attestation de prolongation" generated online. Keep both documents with the original expired card.

Are foreign students with 964 h/year permission considered ‘authorised’?

Yes, provided their weekly limit (20 h) is respected and the work matches the student status. You must still keep a copy of the student card and the last transcript.

What happens if a director personally hires an undocumented domestic worker?

Private households fall under the same rules: fines up to €45,000 and 3 years in prison, plus a five-year ban on public office.

Can I deduct the fines from corporate taxes?

No. Article 39-2 of the Tax Code prohibits deduction of penalties and fines from taxable profit.

Turn Compliance Into a Competitive Advantage

Worksite shutdowns and six-figure fines can cripple a business. With ImmiFrance, you can eliminate the guesswork:

- Pre-hire document checks by certified immigration experts.

- Emergency representation during labour inspections.

- Complete employee regularisation dossiers with a success rate above 92 %.

Contact us today for a free 15-minute assessment and keep your growth plans on solid legal ground.