Carte de Séjour “Passeport Talent — Investor”: Building a Solid Business Plan

Getting the four-year, renewable Carte de séjour « Passeport Talent – investisseur » hinges on one document that prefectures and the Ministry of the Interior scrutinise line by line: your business plan. Even if you already meet the legal investment threshold (€300 000 in equity or reinvested profits and at least 10 % of the company’s capital), a vague or incomplete plan can trigger requests for additional information, delays, or outright refusals.

Below you will find a proven framework—tested in 2025 files handled by ImmiFrance’s partner lawyers—for drafting a plan that satisfies both immigration officers and economic-development desks.

1. Understand the Legal Checklist First

Before you start writing, map every plan section to the legal criteria in Article L421-18 of the CESEDA and its 18 February 2024 implementing decree. Prefectures will verify that your project:

- Involves a personal investment of at least €300 000 (cash or reinvested profits) in fixed or intangible assets located in France.

- Grants you direct ownership of ≥ 10 % of the company’s capital (or control through a holding vehicle you majority own).

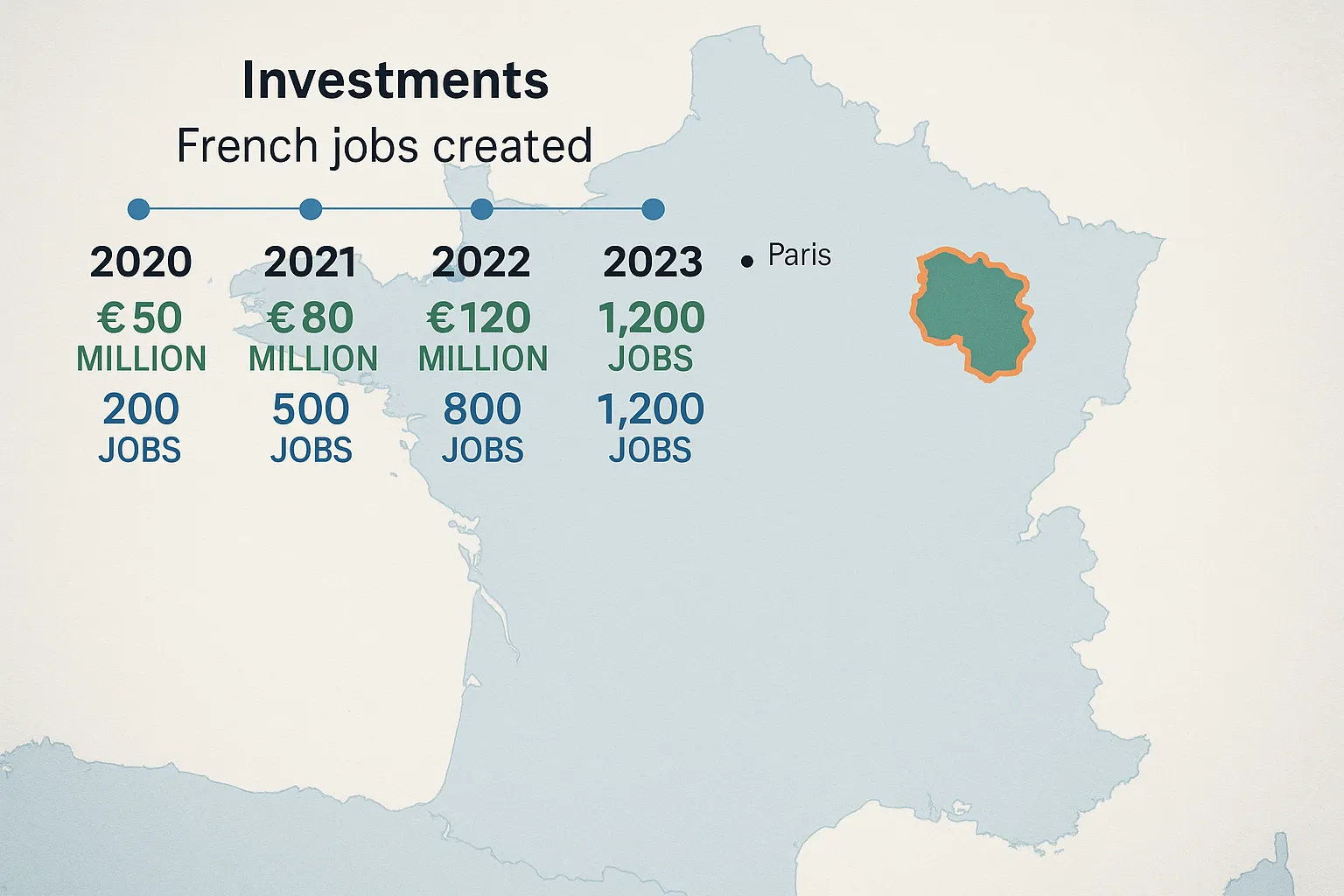

- Creates or protects jobs in the French territory within four years of the investment.

If any of these elements is missing or poorly evidenced, the officer may issue a “request for additional documents” (RAR) that pauses the 90-day processing clock. Building the answers into the plan from day one is the best defence.

2. The Eight Core Sections Prefectures Expect

The content requirements are not formally codified, but internal guideline DGPAF-PTI/2024 stresses a structure close to what French banks ask for when extending credit. ImmiFrance recommends the following eight-part outline:

| Section | What to Prove | Tips & Typical Supporting Evidence |

|---|---|---|

| Executive Summary | Clarity of purpose and compliance with investor-permit rules | Keep it to one page, mention investment amount, equity share, job targets and timeline upfront |

| Promoter Profile | Your experience and financial solvency | Scan of diplomas, LinkedIn metrics, past exit data, personal bank statements |

| Company Overview | Legal structure, capital table, sector | Include K-bis if already incorporated; otherwise term-sheet for planned SAS/SARL |

| Market Analysis | Demand in France/EU, competitors, pricing | Cite INSEE, BPI France Le Lab or Eurostat data; add customer interviews |

| Strategy & Operations | Location, suppliers, distribution, milestones | Gantt chart showing quarter-by-quarter actions for 4 years |

| Investment Plan | Source of funds, spending breakdown, ownership | Table with cash contributions, reinvested profits, and CAPEX categories |

| Financial Projections | P&L, cash-flow, and balance-sheet forecasts over 4 years | Stress-test with 15 % revenue downside; explain assumptions |

| Job-Creation & Impact | Number, type and timing of French jobs | Use NAF codes and median salaries, cite URSSAF cost estimates |

3. Sizing the Investment: How Much Is Enough?

The law fixes €300 000 as the floor, but many préfectures—especially Paris, Hauts-de-Seine and Rhône—like to see a buffer. In our 2024–2025 caseload, the median approved investment was €410 000. Reasons to target higher:

- It covers working-capital needs until breakeven and reduces concerns about undercapitalisation.

- It signals seriousness and cushions exchange-rate swings for non-euro investors.

A phased investment (e.g., €200 000 on incorporation and €150 000 in year 2) is acceptable, but spell out the bank escrow or shareholder-loan agreements that guarantee the later tranche.

4. Documenting Source of Funds

Under France’s anti-money-laundering rules, you must evidence the lawful origin of funds. Typical proofs include:

- Recent tax assessments or audited accounts of your previous company.

- Bank statements showing accumulated savings.

- Sale-of-property deeds translated into French.

Avoid sending originals; notarised or certified copies plus sworn translations suffice. For large crypto conversions, add a MiCA-compliant exchange statement and the bank’s KYT certificate.

5. Financial Forecasts: Three Key Ratios Officers Check

Prefecture analysts rarely run a full DCF. Instead they scan for red flags using three ratios:

- Debt-to-equity ≤ 1.5 after the capital injection.

- Cash runway ≥ 12 months at conservative revenue levels.

- Payroll-to-revenue stabilising below 40 % by year 4 in labour-intensive sectors.

If your forecasts breach these ranges, add an annex explaining sector-specific norms or contingency financing (e.g., BPIFrance innovation loan, regional grants).

6. Job-Creation Narrative: Beyond Headcounts

France’s Direccte agents reviewing economic-benefit opinions look for qualitative impact too. Strengthen your narrative with:

- Skill level: apprenticeships or VIE positions score extra points.

- Regional balance: locating outside Paris Ile-de-France can fast-track opinions.

- Green-economy angle: align with France 2030 investment themes.

Include a hiring timeline chart and sample job descriptions in the annexes.

7. Linking Your Plan to Immigration Evidence

Remember that the business plan is only one piece of the immigration dossier. Cross-reference it with:

- Form Cerfa 15614 01 (Passeport Talent investor) – line 5 asks for job-creation targets; quote the exact figure from the plan.

- Prefecture appointment confirmation – attach it in an annex to show procedural readiness.

- Draft Articles of Association – match equity percentages to the plan’s cap-table.

Pro tip: put corresponding document numbers (e.g., “Annex B3”) in both the plan and the prefecture checklist to help the officer navigate.

8. Common Pitfalls—and How to Avoid Them

- Over-optimistic revenue curves. Use conservative market-share assumptions backed by data.

- Missing French translations. Even bilingual plans must have French as the primary language; keep English in a parallel column if needed.

- Inconsistent job figures between the plan, Cerfa form and projected payroll line in the P&L.

- No proof of premises. A simple bail précaire (short-term commercial lease) or domiciliation contract shows commitment.

- Ignoring social-security costs. Include gross-to-net salary calculations using 2025 URSSAF rates (≈ 42 %).

9. Submission Format and Timeline

- Length: 25–40 pages plus annexes.

- File size: keep under 10 MB for ANEF uploads; compress PDFs.

- Timing: submit with initial visa application if outside France, or at the “change-of-status” appointment if you already hold another French permit.

- Review time: economic-benefit opinion (DREETS) averages 30–45 days; prefecture decision another 30–45 days.

Building in a 90-day buffer before any travel or planned operational launch is prudent.

10. Leveraging Professional Support

While drafting a credible plan is feasible alone, many investors choose professional help to align immigration, tax and corporate-law angles. ImmiFrance’s investor desk offers:

- Business-plan audits by investment-immigration experts.

- Coordination with specialised French lawyers and chartered accountants.

- Prefecture appointment booking and ANEF dossier upload.

- Real-time case tracking via your encrypted client portal.

Frequently Asked Questions

Can I invest through a foreign holding company? Yes, provided you ultimately own it and can prove the chain of ownership with certified registries and translations.

Is passive real-estate investment eligible? Generally no. The law requires an active commercial or industrial project that creates or protects jobs.

How soon must the €300 000 be wired? Funds must be available at the time of application or placed in a French escrow; staged investments are possible if contractually guaranteed.

What happens if I miss the job-creation target? Prefectures review the commitment at renewal. Shortfalls can lead to a one-year card instead of four years, or refusal in severe cases.

Can my family join me? Yes. Spouse and minor children qualify for accompanying Passeport Talent family cards with the same validity as yours.

Ready to Secure Your Investor Permit?

A polished, evidence-rich business plan is the single most powerful tool for winning a Passeport Talent investor card on the first try. If you want an expert review—or end-to-end dossier preparation—schedule a free 15-minute eligibility call with ImmiFrance today and move one step closer to launching your venture in France.