Moving a Non-EU Domestic Employee to France: Visa Options and Costs

Hiring a trusted nanny, housekeeper or personal caregiver you already know can make an international move far easier—yet privately relocating a non-EU domestic employee to France involves far more than just booking the same flight. French immigration law treats household staff like any other salaried worker: a work authorisation must be secured before the visa, a written contract must respect the Labour Code, and both employer and employee face significant financial obligations.

This guide explains the 2025 visa options, timelines and real-world costs so you can evaluate whether bringing your helper is feasible—and how ImmiFrance can streamline the paperwork at every step.

Why the Right Visa Matters

Attempting to enter on a tourist visa and “sort things out later” exposes you to steep fines and even criminal charges for concealed work. Since 1 July 2025, workplace inspections have doubled under the new Immigration & Integration Act, and penalties for undeclared domestic staff can reach €15 000 plus a five-year hiring ban (see our article on employer sanctions for hiring undocumented workers in 2025). Obtaining the correct long-stay visa (VLS-TS) from day one protects you, your employee and your family life in France.

Eligibility Basics and Minimum Conditions

- Written contract in French using the standard particulier employeur template and filed on the online ANEF-Employeurs portal.

- Full-time or part-time salary at least the current French gross minimum wage (€11.72 per hour, €1 776.92 per month in 2025) plus 10 % paid holidays.

- Accommodation: if lodging is provided, it must be clearly stated and valued in the payslip within URSSAF limits.

- Work permit (Autorisation de travail, AT) issued by the regional DREETS after a labour-market test unless an exemption applies.

- Private medical insurance for the first three months, or immediate enrolment in social security once salaried activity starts.

Failure to meet any of these points leads to a visa refusal or, worse, an entry ban (IRTF).

Visa and Residence-Permit Routes for Domestic Employees

| Route | Typical situation | Duration | Work-permit step? | Key legal reference |

|---|---|---|---|---|

| 1. VLS-TS « Salarié – Particulier employeur » | You permanently hire a nanny, housekeeper or caregiver for your French residence | 12 months renewable into a multi-year carte de séjour « salarié » | Yes – AT via ANEF | CESEDA L421-3, Arrêté 4 Jan 2025 |

| 2. VLS « Travailleur temporaire » (< 12 months) | Seasonal or trial period under one-year contract | Length of contract (max 11 m) | Yes, shorter validity AT | CESEDA L422-1 |

| 3. Accompanying family staff of diplomatic/consular officials | Employee already registered with Ministry for Europe and Foreign Affairs | Up to official’s posting | No AT, but MFA accreditation | Vienna Convention + CESEDA R431-26 |

| 4. Intra-group transfer / Passeport Talent categories | Rare for household staff; only if employed by overseas company | 12–48 m | Company-level attestation, no labour-market test | CESEDA L421-24 |

Most private households fall under Route 1. Below we detail its timeline and price tag.

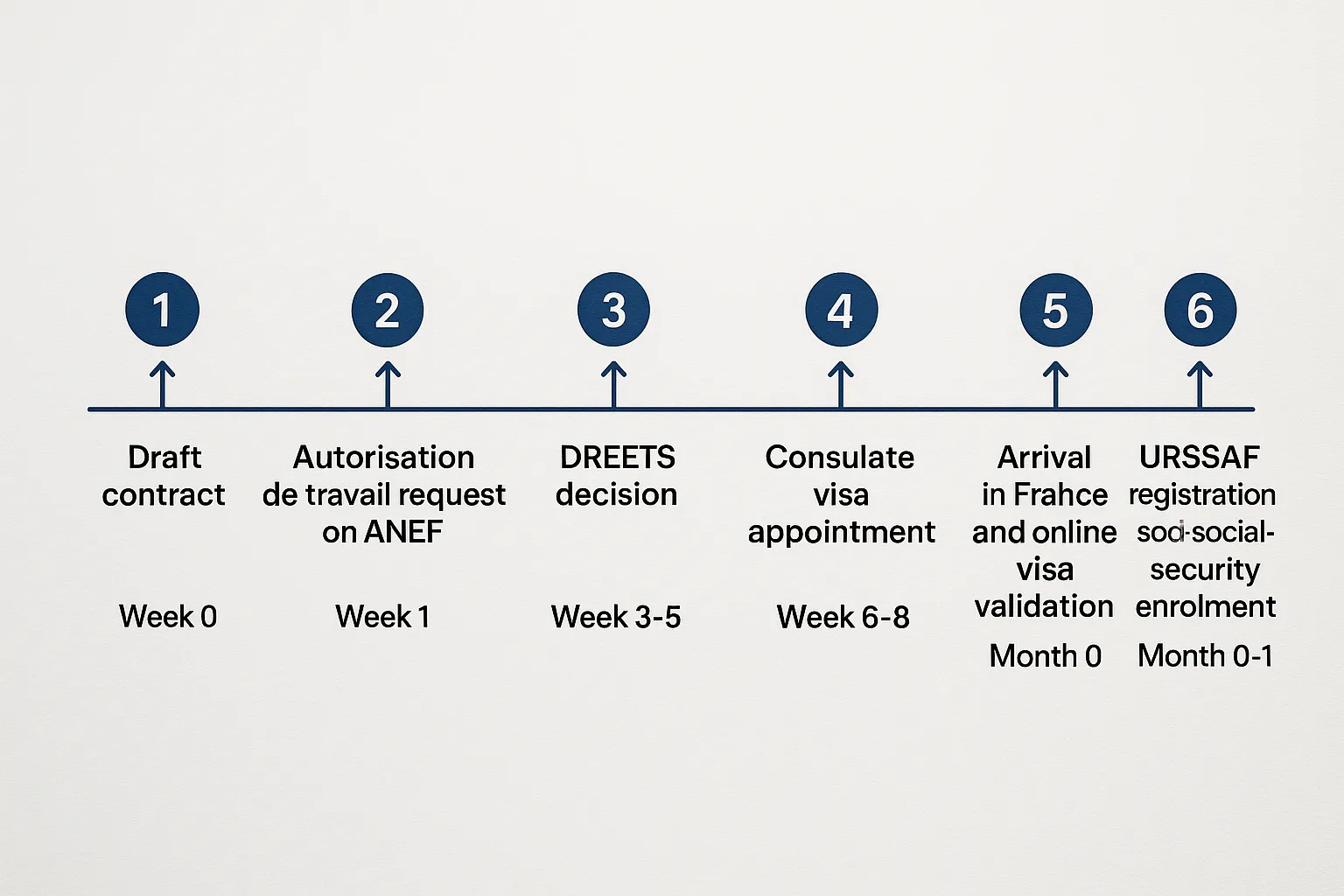

Step-by-Step Timeline (2025 Edition)

- Week 0 – Draft CDI or CDD contract using the CCN des salariés du particulier employeur. Prepare proof of your income (last three payslips or tax notice) to show you can afford the wages.

- Week 1 – Submit AT request on the ANEF-Employeurs portal. Pay the €58 instruction fee online.

- Week 3–5 – DREETS issues the electronic work authorisation. Download the PDF; the employee will need it for France-Visas.

- Week 6–8 – Employee books a consulate biometric appointment, submits France-Visas file and pays the €99 fee.

- Day 0 in France – Employee receives the VLS-TS sticker, flies to France, and must validate the visa online within 3 months (tax €200 via timbre fiscal).

- Month 1 – You declare the hire on the URSSAF Particulier employeur portal and begin monthly salary and contribution payments.

Average total processing time: 8–10 weeks when paperwork is complete.

True Cost Breakdown (Employer & Employee)

| Item | Who pays | Amount (2025) |

|---|---|---|

| ANEF work-permit instruction fee | Employer | €58 |

| Consulate VLS-TS fee | Employee | €99 |

| OFII validation tax (timbre fiscal) | Employee | €200 |

| Residence-permit tax at first renewal | Employee | €225 |

| URSSAF employer social contributions | Employer | ≈ 40 % of gross salary (after small household rebates) |

| URSSAF employee contributions | Deducted from salary | ≈ 23 % of gross salary |

| Salary (minimum legal) | Employer | ≥ €1 776.92 gross per month |

| Optional: private health cover until CPAM registration | Employer or Employee | €75-€120 per month |

Example for a full-time nanny over the first year

- Gross salary: €1 776.92 × 12 = €21 323

- Employer charges (40 %): €8 529

- Up-front fees: €58 work-permit + estimated €600 agency or translation costs

- Employee pays: €99 + €200 + around €4 904 payroll deductions

Total budget for the first year hovers around €30 000 before any tax credits. French households can usually claim a 50 % income-tax deduction on domestic-employee costs, bringing the net expense below €16 000.

Remember the URSSAF Tax Credit Advance

If you register on the Cesu+ service, the government now advances the 50 % credit monthly, easing cash flow—yet the underlying contributions must still be paid, so budget accordingly.

Common Pitfalls and How to Avoid Them

- Labour-market test mismatch: you must advertise the position for at least three weeks on Pôle Emploi before filing the AT, unless the employee already lives with you abroad (emploi de confiance exception rarely accepted).

- Incomplete contract clauses: specify working hours, rest days, overtime rates and in-kind benefits. Prefectures reject vague contracts.

- Late visa validation: forgetting the OFII online payment within 90 days results in a €180 fine and prefecture queue.

- Wrong payroll portal: use Particulier employeur (Cesu or Pajemploi) rather than the business URSSAF interfaces to access household rebates.

- Travel while renewal is pending: your employee will need a récépissé or visa de retour to re-enter France. Plan renewals at least two months before expiry.

How ImmiFrance Simplifies the Process

- Pre-filing audit: we review your draft contract, income and advertisement to flag issues before the ANEF submission.

- End-to-end ANEF handling: our advisers create the employer account, upload documents and monitor DREETS messages in real time.

- Consulate kit for the employee: personalised checklist, French translations, and interview coaching to cut appointment refusals.

- Post-arrival onboarding: we validate the VLS-TS online, set up FranceConnect+, and register the employee on Cesu+ so you start paying legally from month one.

- Renewal and long-term planning: after 12 months we prepare the multi-year carte de séjour file and advise on social-security enrolment and tax-return obligations (see tax filing for first-year residents).

With a 92 % success rate on household-staff permits since 2023, ImmiFrance turns a multi-agency labyrinth into a single digital dashboard—so you can focus on settling your family, not chasing prefecture slots.

Ready to start?

Book a free 15-minute call with an ImmiFrance adviser to check eligibility and receive a personalised cost estimate for your employee’s move to France.