Car Registration in France as a Non-Resident: Avoiding Fines

Steering a vehicle with foreign plates across French roads may feel liberating—until the first automatic camera flashes your tag or a roadside checkpoint discovers your paperwork expired. Since January 2025, French customs (Douanes) and the traffic police (CRS/Gendarmerie) have stepped-up joint operations to spot non-resident drivers who overstay the generous but limited grace periods. The fine for “circulation sans immatriculation régulière” now reaches €750, your car can be immobilised on the spot, and the prefecture may impose storage fees of €6 to €30 per day (§ R322-5 and R325-3 Code de la route).

This guide unpacks when a foreign-registered car must be switched to French plates, outlines each administrative step, and offers tactical tips to stay compliant even if your immigration status is still in progress.

1. Do You Count as “Non-Resident” for Vehicle Law?

Under article R322-1 of the Code de la route, residency for car-registration purposes is linked to your “établissement en France”—not (only) your immigration paperwork. You are considered established if:

- You spend > 185 days in France during any rolling 12-month period, or

- Your principal place of work or family life is here (spouse/children, long-term lease, etc.).

Typical situations and the clock that applies:

| Driver profile | Grace period on foreign plates | Key evidence authorities review |

|---|---|---|

| Tourist / business visitor | Up to 6 consecutive months per year | Entry stamps, accommodation invoices, toll logs |

| Second-home owner staying < 6 months/year | Same 6-month rule, renewable annually | EDF bills, airline tickets |

| New employee or student just arrived | 1 month from the date you become resident | Work contract, enrolment certificate, lease |

| Returning French expat importing a car | 1 month from entry in France | Customs form 846 A, airline ticket, tax affidavit |

⚠️ An undocumented migrant who has lived in France more than six months already meets the “established” criterion—even without a residence permit. The vehicle must therefore be regularised within 30 days of reaching that threshold to avoid fines.

2. The Four Pillars of French Car Registration

Registering—technically “demander une carte grise”—is now 100 % online via the ANTS portal. Yet four separate administrations touch your file:

- Douanes (French Customs): releases form 846 A for non-EU cars or the quitus fiscal for EU vehicles.

- DGFIP (Tax Office): collects the regional registration tax, CO₂ malus, and the new 2025 weight surcharge.

- DREAL/UTAC: verifies conformity for used imports older than 30 months or vehicles lacking an EU type-approval.

- Ministry of Interior (ANTS): issues the immatriculation and tracks enforcement.

Understanding which pillar applies to you avoids back-and-forth—and penalties.

2.1 Customs clearance or quitus fiscal

- EU-purchased vehicle: Obtain a quitus fiscal at your local Service des Impôts des Entreprises (SIE) within 15 days of arrival. Bring the purchase invoice, foreign registration certificate, and proof of address. The document confirms VAT status (owed or exempt).

- Non-EU origin: File form 846 A at the border or a customs office within 72 hours. Pay 10 % import duty + 20 % VAT unless you qualify for personal effects exemption (returning resident, student, marriage move).

2.2 Technical inspection (contrôle technique)

Any car over four years old must pass a French contrôle technique before you can request plates. EU certificates may be accepted if less than six months old, but many prefectures still demand a French test to avoid disputes.

2.3 Certificate of conformity (COC)

A Certificat de conformité européen proves the model meets EU type-approval. You can often download the e-COC from the manufacturer for €120-€250. Used Japanese or U.S. imports usually require an UTAC-RTI single-vehicle approval—budget €900-€1 400 and four to eight weeks.

2.4 Registration tax & ecological penalties (2025 rates)

| Item | 2025 rule | Amount |

|---|---|---|

| Regional tax (cheval fiscal) | Depends on your région (Île-de-France: €54 × CV) | €216 for a 4 CV sedan |

| Fixed fee (frais de gestion) | Nationwide | €11 |

| Delivery fee (redevance acheminement) | Nationwide | €2.76 |

| CO₂ malus (cars first registered ≥ 1 Jan 2025) | Starts at 118 g/km | €50 – €60 000 |

| Weight tax (> 1 800 kg) | €10 per kg over threshold | Varies |

Payable by credit card directly in the ANTS workspace. The system blocks plate issuance until full payment clears.

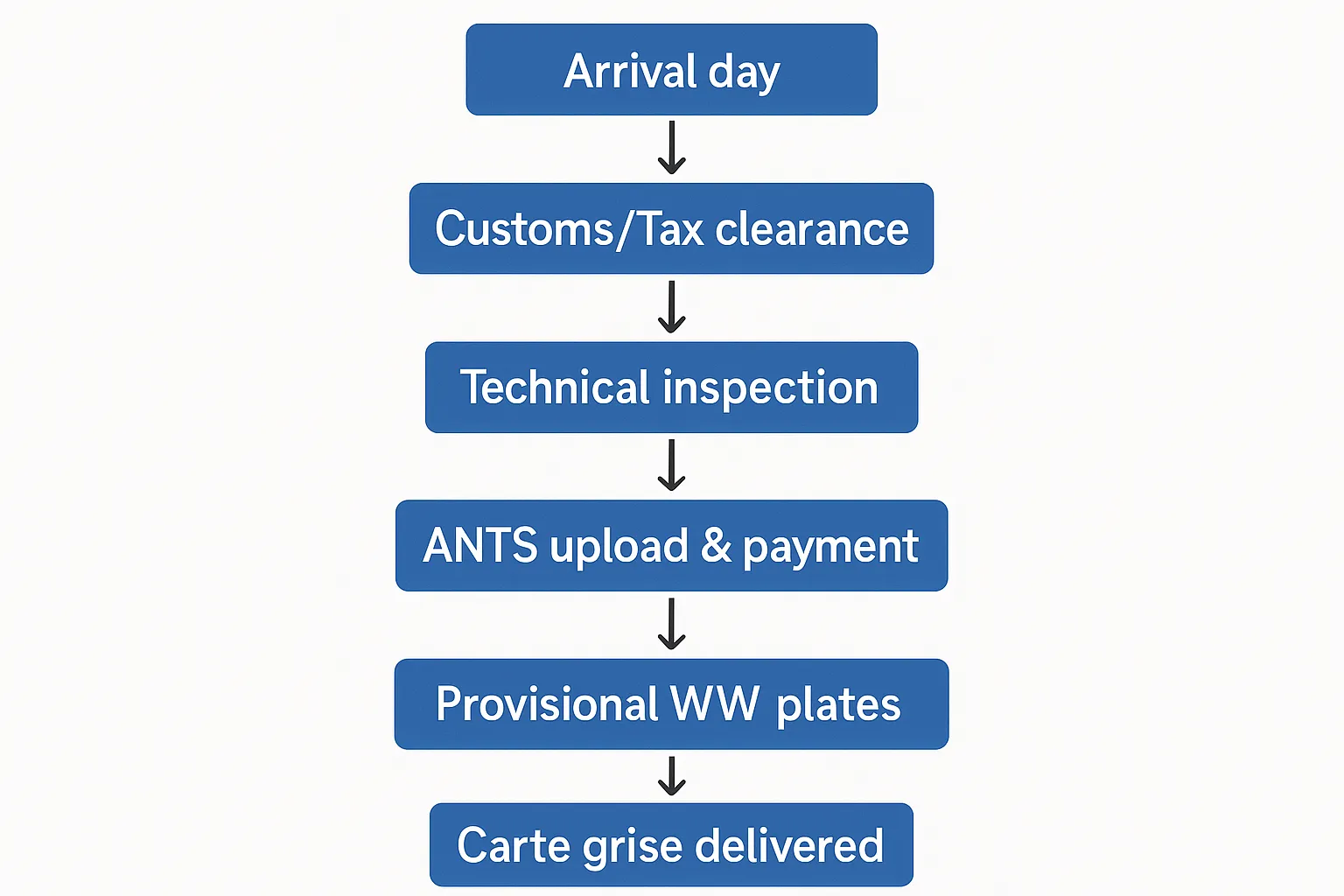

3. Step-by-Step: Switching to French Plates in 30 Days

- Gather core documents

- Passport or valid ID

- Proof of address < 6 months (utility bill, attestation d’hébergement)

- Foreign registration certificate (both sides)

- Bill of sale or gift deed translated into French

- Quitus fiscal or 846 A

- COC or UTAC approval

- Recent contrôle technique (if applicable)

- Create or upgrade a FranceConnect+ account (see our guide on Digital FranceConnect for security tips).

- Open an “Immatriculation d’un véhicule importé” request on ANTS and upload scans (PDF < 1 Mb each).

- Pay taxes online. Keep the Numéro de télépaiement.

- Receive provisional WW plates by email within minutes if documents are complete. Print and affix while waiting.

- Track file under “Mes démarches” and answer any avis de complétude within 15 days.

- Receive the carte grise by secure La Poste in 2–8 business days. Final plates must be mounted within 72 hours.

Timing pitfalls

- Appointment bottlenecks: Some SIE offices now require online booking two weeks out. Do not wait; request a quitus fiscal straight after crossing the border.

- Financing paperwork: If the vehicle is still under credit abroad, obtain a lender authorisation letter; French prefectures reject cars with outstanding foreign liens.

- Insurance gap: French insurers issue green cards only after you provide either foreign plates + VIN or provisional WW plates. Plan sequencing to avoid driving uninsured—a criminal offence carrying a €3 750 court-imposed fine.

4. Automated Enforcement Ramps Up in 2025

The LAPI system (automatic licence-plate readers) used by police cars and toll-road gantries now cross-refer ANTS databases daily. A foreign plate flagged as overstaying the 6-month limit triggers a roadside stop order. In 2024, the Interior Ministry reported 23 % more immobilisations for unregistered foreign vehicles compared with 2023. Expect that figure to rise further after the July 2025 immigration law tightened data-sharing between customs, tax and police.

Penalties hierarchy:

- Fixed fine €135 for missing quitus fiscal or failing to present the carte grise within 5 days (§ L121-2).

- Class-4 offence €750 for no French registration after 30 days of residency (§ R322-5).

- Vehicle immobilisation & seizure until taxes and storage fees are paid (§ R325-3).

- Insurance surcharge: Your French insurer may refuse coverage for an incident if the car was illegally registered, exposing you to personal liability.

5. Special Cases & Workarounds

5.1 Still waiting for your residence permit

Many readers hold a récépissé or are mid-appeal against an OQTF. You still can register a car provided you show a valid passport and proof of address. Prefectures cannot refuse the procedure on immigration grounds, as per Conseil d’État, 14 Oct 2022, n° 459742. If an official blocks your file, lodge a référé-mesures-utiles at the Administrative Court.

5.2 Students on short programmes (< 12 months)

Students enrolled for under a year may keep foreign EU plates throughout their stay, but must carry a dated enrolment certificate and accommodation proof to justify the exemption during checks. Selling the car in France is prohibited without first obtaining French plates.

5.3 UK and Swiss residents post-Brexit

The mutual recognition of UK V5C forms ended in 2024. British residents now need a paid COC from the manufacturer plus customs form 846 A. Swiss residents, although outside the EU Customs Union, can claim duty-free import if they owned the car ≥ 6 months and transferred domicile. Have the Swiss form 13.20A stamped on exit to speed clearance.

5.4 Undocumented migrants regularising through work

Preparing a strong “Admission exceptionnelle au séjour” dossier often includes proof of tax contributions. Registering your vehicle and paying the cheval-fiscal tax produces an “avis de somme à payer”—useful evidence of integration and fiscal good faith. Tie the move with other compliance steps like first-year income-tax filing (see our dedicated guide).

6. Environmental Obligations Few Expats Notice

- Crit’Air vignette: Mandatory to drive in low-emission zones (LEZ) of 11 major French cities. Order the €3.72 sticker online once your registration is complete.

- Eco-tax at resale: Selling a high-CO₂ import before 24 months triggers repayment of any malus discount you obtained.

- Recycling fee (écoparticipation): Added to the carte-grise invoice for electric-car batteries starting March 2025.

Failure to display the vignette results in a €68 class-3 fine, easily issued by mobile cameras.

7. Five Tactics to Avoid Fines and Administrative Headaches

- Start the quitus fiscal process online: several regions (Occitanie, Auvergne-Rhône-Alpes) accept email submissions; you’ll receive a stamped PDF within 48 h.

- Book the contrôle technique before arrival so you can drive straight to the centre with foreign plates—legal under article R323-1.

- Print the ANTS confirmation page to show police if provisional plates are delayed.

- Keep a “border-crossing dossier” in your glove compartment: fuel receipts, toll tickets, parking apps with geolocation prove arrival dates if questioned.

- Use ImmiFrance’s bilingual plate-conversion kit: we pre-check your documents, request missing translations, create your ANTS file, and track tax payments in real time—cutting average issuance time to 7 days.

8. How ImmiFrance Can Accelerate Your Registration

Putting foreign plates in order while juggling residency deadlines, translations and tax filings can overwhelm even seasoned expats. Our advisers:

- Audit your customs and tax position to minimise duties legally.

- Obtain certified translations in 24 h via sworn translators accepted by all prefectures.

- Create or upgrade your FranceConnect+ account securely and fill the ANTS application on your behalf.

- Follow up with DREAL or UTAC when a single-vehicle approval is required.

- Intervene with the prefecture if a file stalls beyond legal processing times.

Book a 20-minute free eligibility call to map out your timeline and avoid the €750 fine trap.

Driving in France should be about enjoying Alpine passes and Atlantic coastlines—not sweating every siren in the rear-view mirror. Tackling registration within the first 30 days, keeping clean documentation, and leveraging expert help where needed will let you cruise French roads legally and stress-free.