Income Requirements for Visitors Visa Extensions After Retirement

Leaving the workforce and swapping the daily grind for croissants and Provençal markets sounds idyllic—until your French visitor visa approaches its expiry date and the prefecture asks for “juste preuve de ressources stables et suffisantes”. For retirees, the income test is the single biggest hurdle to extending a long-stay visitor status (visa de long séjour valant titre de séjour – VLS-TS « visiteur ») or obtaining the annual carte de séjour « visiteur ». This guide breaks down the 2025 financial thresholds, acceptable proofs and clever tactics to keep enjoying France without immigration headaches.

1. Why the Income Test Exists

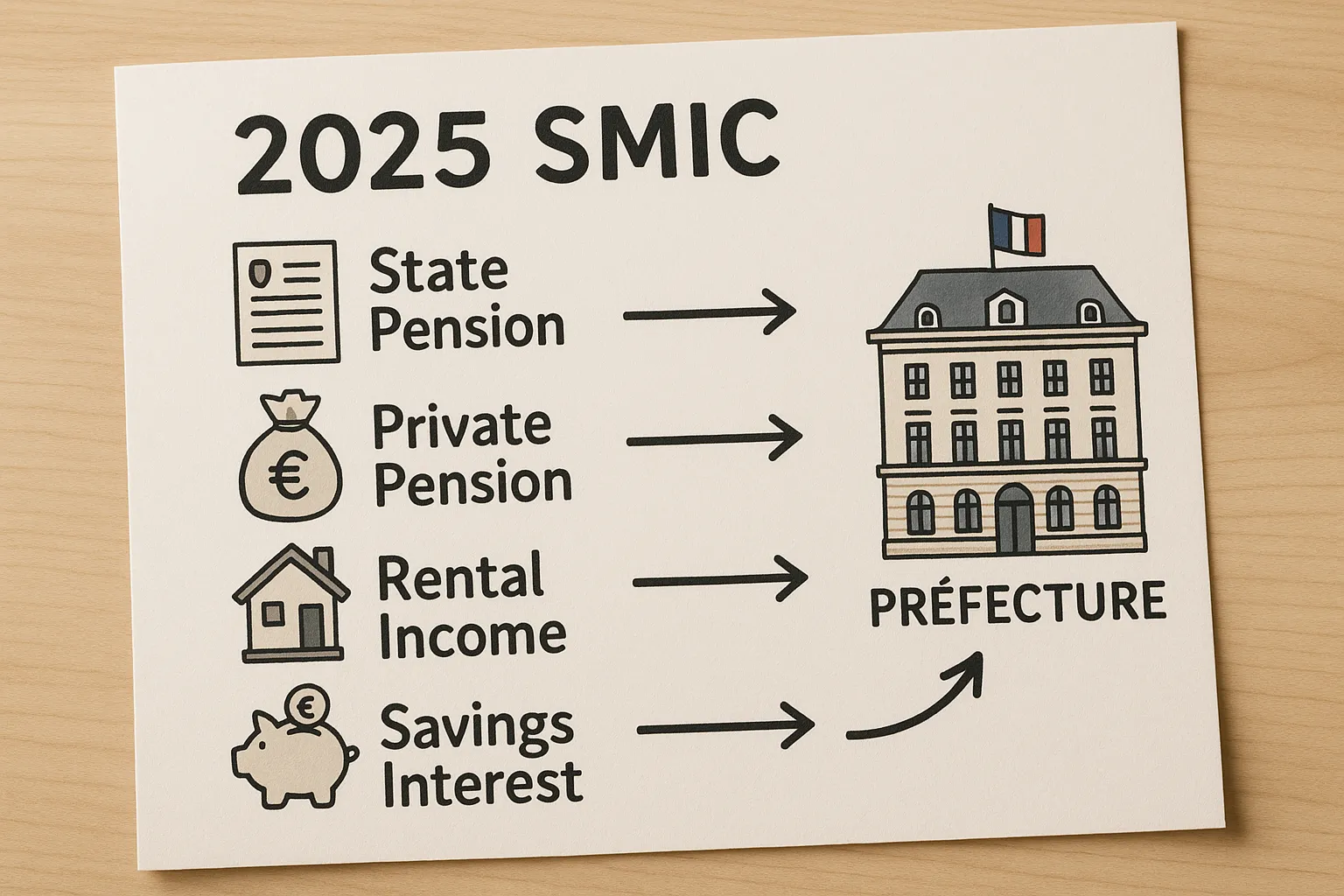

Article L.412-1 of the French Code des étrangers (CESEDA) requires visitor-status foreigners to demonstrate that they will not become a burden on public funds. A 2004 Council of State ruling clarified that “sufficient means” should equal—or exceed—the French minimum wage unless a decree sets a higher bar. Prefectures therefore use the Salaire minimum interprofessionnel de croissance (SMIC) as their reference and publish internal circulars each January stating the exact amount applicants must meet.

2. 2025 Minimum Income Thresholds

As of 1 May 2025, the monthly SMIC is €1 833.15 gross, roughly €1 440 net after social charges. Most prefectures require 100 % – 120 % of the net figure for a single applicant, rising for spouses and dependent children.

| Household Situation | % of Net SMIC Required | 2025 Monthly Amount (€) | Annual Amount (€) |

|---|---|---|---|

| Single retiree | 100 % – 120 % | €1 440 – €1 730 | €17 280 – €20 760 |

| Couple | 150 % – 180 % | €2 160 – €2 590 | €25 920 – €31 080 |

| Each dependent child | +10 % – 15 % | +€145 – €215 | +€1 740 – €2 580 |

Important: Some high-pressure départements (Paris, Alpes-Maritimes) systematically apply the upper end of the range. Always check the préfecture’s website or your last récépissé for the exact figure.

3. What Counts as “Stable and Sufficient” Income?

Retirees can mix and match resources as long as they are predictable, legal and documented:

- State pension(s): France accepts foreign pension statements if issued by an official body and translated by a sworn translator (traducteur assermenté).

- Private or occupational pensions: Annual benefit letters plus the last six monthly payments landing in a bank account.

- Annuities or life-insurance withdrawals (rente viagère): Must be contractually guaranteed for life.

- Rental income: French or foreign real-estate earnings supported by leases, land-registry extracts and the last three rent payments.

- Interest and dividends: Only if paid regularly and clearly identified on bank statements.

- Savings capital: A hefty savings balance can compensate for a temporary shortfall, but most prefectures want at least 12 months of the threshold sitting in an account after deducting living expenses.

Non-Qualifying Resources

- One-off proceeds from a house sale (deemed non-recurring)

- Undocumented cash deposits

- Crypto-currency gains without a traceable statement

4. Building a Bullet-Proof Financial Dossier

- Translate early: Pension letters, tax returns and leases issued outside France must be translated by a sworn translator before your appointment.

- Show payments hitting a French IBAN: Prefectures get nervous when money sits abroad. Open a local account (see our guide on opening a French bank account remotely) and set up automatic transfers.

- Stabilise exchange rates: If your pension is paid in dollars or pounds, transfer at least six months in advance to prove the euro net amount meets the bar despite currency swings.

- Add a tax footprint: Filing a French tax return—even one showing zero tax—reinforces residency ties. Our article on first-year tax filing explains how.

- Compile statements chronologically: Six most recent monthly statements plus an annual overview help examiners verify consistency.

5. Timing Your Renewal Correctly

- VLS-TS holders: Validate online within 3 months of arrival. Apply for renewal between 60 and 90 days before the one-year mark.

- Carte de séjour “visiteur”: Renewal window opens four months before expiry. Missing the deadline triggers a €180 penalty and may force a fresh visa in your home country.

Keep in mind strike disruptions (see the 2025 prefecture strike calendar). Collect proof of attempted bookings to avoid “late filing” refusals.

6. Strategies if Your Income Falls Short

- Combine pension + savings: Show the shortfall covered by a 12-month savings buffer.

- Spousal aggregation: Prefectures assess household income jointly; a working spouse can bridge the gap.

- Rental a spare room: Declared French rental revenue counts if you provide the tenant’s lease and last three payments.

- Revisit exchange-rate assumptions: Prefectures use the Banque de France monthly average—not spot rates—to convert foreign income. Print the official table as evidence.

7. Common Pitfalls That Sink Applications

- Submitting annual pension statements without corresponding monthly bank inflows.

- Large unexplained cash deposits just before filing (“suspected gift”).

- Forgetting to translate supporting documents or translate them with non-sworn services.

- Relying on a joint account in another country without French access—the prefecture may question liquidity.

- Ignoring tax obligations. Even visitors must declare worldwide income once resident > 183 days.

8. Renewal Process: Step-by-Step Snapshot

- Create/Log in to ANEF account (visiteur module).

- Upload ID, proof of address < 6 months, full financial dossier, health insurance certificate, and tax return.

- Pay €225 tax stamp online (includes €25 droit de timbre + €200 droit de visa long séjour).

- Receive récépissé by email (valid for travel inside Schengen—see our dedicated Schengen travel guide).

- Attend biometrics appointment if requested.

- Pick up the new card within 3–6 weeks.

9. Health Insurance & Tax After Renewal

- Health: Visitors must keep private medical coverage but can optionally join the PUMA system after three months’ residence if they pay the annual contribution (8 % of worldwide income above the threshold). Our CPAM registration guide explains the process.

- Tax: Even if pensions are taxed abroad, file a French déclaration 2042 to prove compliance and support future naturalisation plans.

10. How ImmiFrance Simplifies the Money Question

Collecting, converting and translating decades of pension paperwork is tedious. ImmiFrance offers:

- Prefecture-specific income threshold briefings

- Sworn translation coordination in 48 hours

- Currency-conversion attestations stamped by French notaries

- ANEF upload and tracking so nothing goes missing

- Lawyer referrals if a refusal or OQTF occurs despite solid finances

Book a free 15-minute eligibility call to get your personalised income checklist and avoid surprises on appointment day.

Frequently Asked Questions

Can I use my spouse’s income if the visa is in my name? Yes. Prefectures examine household resources. Upload your spouse’s income proofs and the marriage certificate (translated if necessary).

Are lump-sum savings alone enough? Occasionally. Most prefectures ask for at least 12 months of the threshold held in liquid euros on top of day-to-day spending.

Do I need French health insurance to renew? Private coverage that meets Schengen standards is mandatory until you join the public system via PUMA.

Will currency fluctuations during the year cause a refusal? Not if you show regular transfers that already account for typical swings and keep a small euro buffer.

Is the income threshold lower outside Paris? Some low-population prefectures accept 100 % of net SMIC, but double-check local guidance before assuming a discount.

Ready to secure your post-retirement life in France? Schedule a free call with an ImmiFrance adviser and receive a bespoke income-proof kit tailored to your prefecture in less than 24 hours.