Prefecture Checklist: Preparing Evidence of 8 Payslips for Work Regularization

Why eight payslips matter for work regularization

If you are living in France without a residence permit but have been working legally with payslips, the “regularization by work” (admission exceptionnelle au séjour – CESEDA L435-1) may open the door to a one-year salarié card and, eventually, long-term stability. In virtually every prefecture, the first document the clerk looks for is a bundle of eight recent payslips. Failing to present them in the right way is one of the most common reasons for a file being declared incomplet.

This article walks you through a practical checklist: how to gather, authenticate, and present your eight payslips, which complementary proofs to add, and the red flags to avoid on appointment day.

1. Understanding the legal basis

- Circular of 28 November 2012 (known as Circulaire Valls): sets the guideline of at least 8 payslips over the last 24 months for undocumented workers who can prove at least 24 months of uninterrupted presence in France.

- Article L435-1 of CESEDA (Code de l’entrée et du séjour des étrangers et du droit d’asile): gives prefects discretionary power to issue a temporary salarié permit when an applicant demonstrates sufficient work integration.

Prefectures retain a margin of appreciation; some may ask for 12 payslips or additional tax statements. However, producing at least eight clean, consecutive payslips remains the national benchmark.

2. Counting the eight payslips: what actually qualifies?

- Time frame: Payslips must be dated within the last 24 months.

- Continuity: Consecutive slips from the same employer are preferable but not strictly mandatory. If you changed jobs, include contracts.

- Originals vs. copies: Bring originals plus one full set of copies. Many prefectures only keep copies but will refuse a file if the originals are not shown.

- Digital payslips: Authorized since the 2017 bulletin de paie numérique. Print them and staple each to its cachet page showing the employer’s SIRET.

3. Preparing your payslip bundle step by step

Step 1 – Check consistency

- Identity: Your surname (even if misspelled) must be the same on every slip. Ask HR to issue a corrected duplicate if needed.

- Contract type: CDD, CDI, interim missions—all are acceptable. Make sure the contract dates align with the payslip dates.

- Net vs. declared hours: Prefectures sometimes call URSSAF to verify. Large unexplained fluctuations can raise doubts.

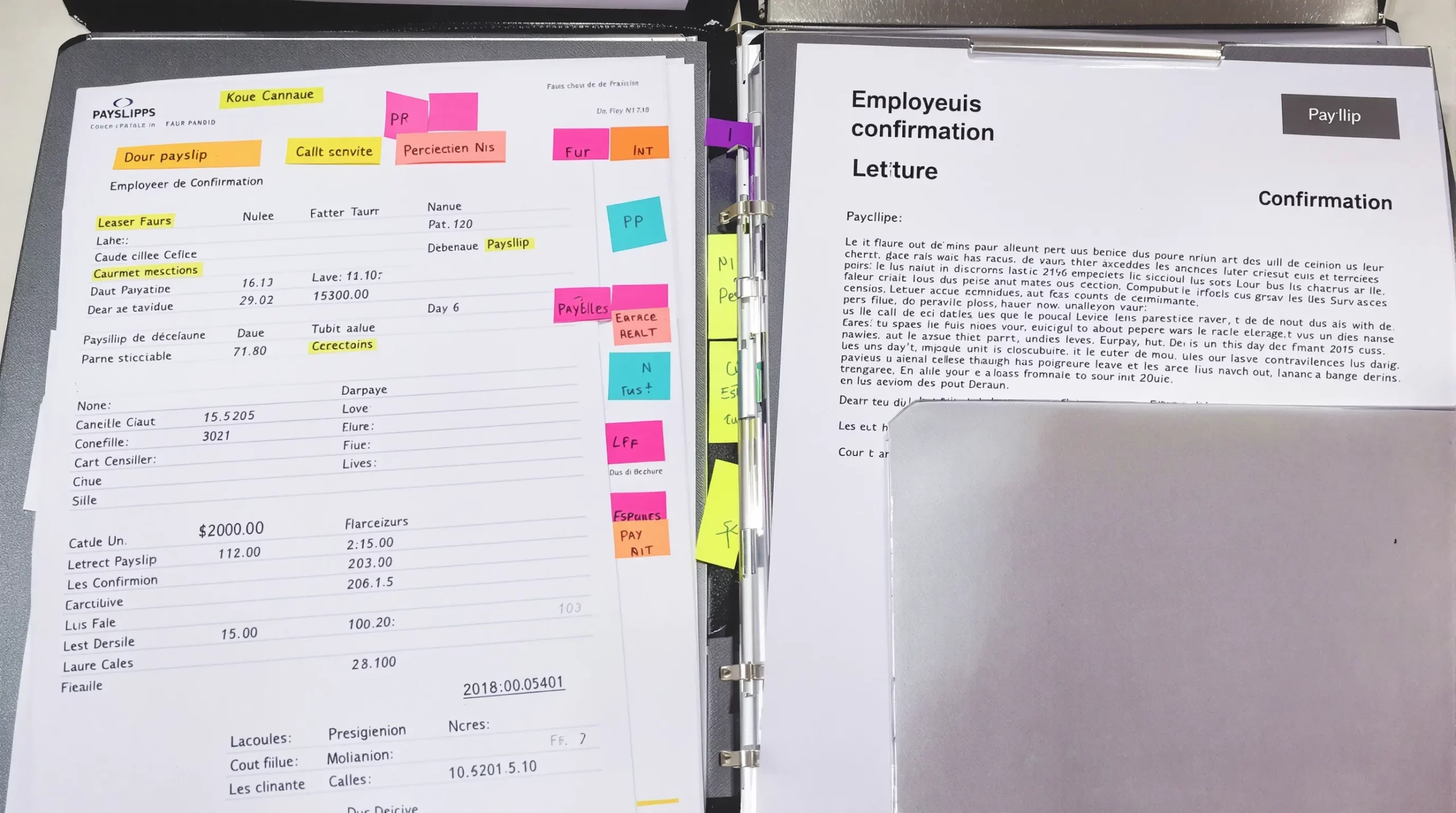

Step 2 – Have your employer sign a confirmation letter

Many prefectures add this to their unofficial checklist. The letter should:

- Confirm the company still employs you on the day of the appointment.

- State weekly working hours and gross monthly salary.

- Mention the employer’s willingness to sign Cerfa 15186-01 (Demande d’autorisation de travail).

- Be on letterhead, dated under 30 days, and signed by the legal representative.

Attach the letter on top of the payslip stack with a paper clip.

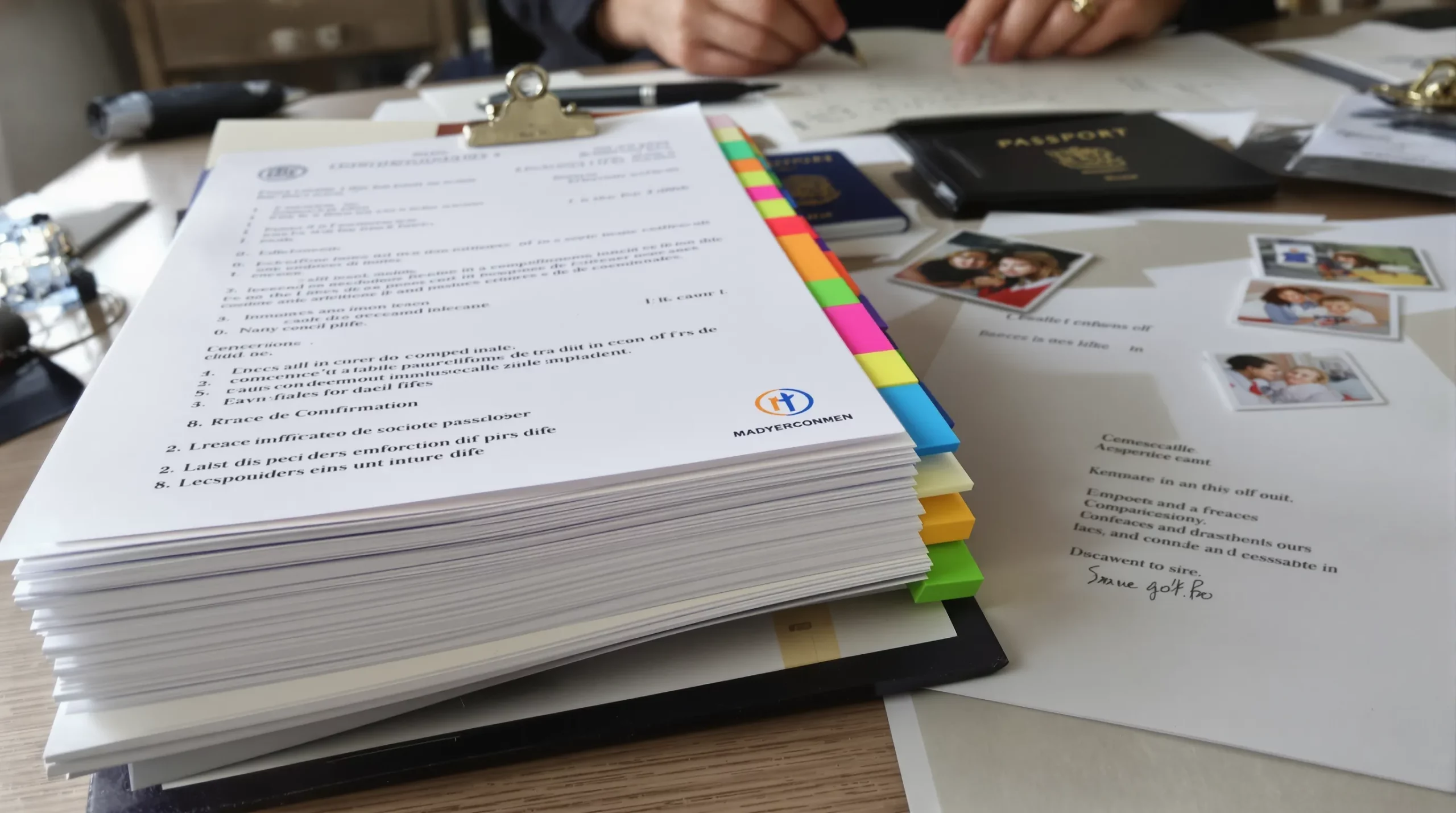

Step 3 – Insert supporting documents

Place them in this order, separated by coloured dividers if possible:

- Work contract(s) matching the payslips.

- Latest avis de situation SIREN/SIRET (download from infogreffe.fr).

- Last URSSAF certificate (attestation de vigilance) if the company can provide it.

- Proof of professional activity continuity (badge logs, mission orders, etc.) if your hours vary.

Step 4 – Make two complete copies

One for the prefecture to keep, one for your own records with a “dépôt” stamp. Copies must be single-sided and perfectly legible; blurry HR scans are often rejected.

4. Common pitfalls that lead to refusal

- Less than the required SMIC hours: If the cumulated hours reveal part-time activity under 24 h/week, expect additional scrutiny.

- Employer under investigation: Prefectures cross-check SIRET numbers. An employer flagged for illegal work may block your file.

- Payslip anomalies: Negative net imposable, blank social security number, or “ADVANCE” written in big letters—all trigger doubts about authenticity.

- Outdated letter: A confirmation letter older than 30 days suggests you may no longer be employed.

When any of these apply, include proactive explanations or updated documents.

5. Supplementary evidence that strengthens your dossier

While eight payslips are mandatory, additional proofs can offset minor gaps:

- Tax evidence (avis d’imposition or declaration pré-remplie). Filing taxes, even with a zero balance, demonstrates good faith.

- CAF or URSSAF attestations of contributions.

- Professional certifications or training completed in France.

- Letters of recommendation from clients or suppliers if you work in BTP or hospitality.

Remember: prefects decide on a case-by-case basis. A solid, coherent story supported by documents dramatically improves your odds.

6. Day-of-appointment checklist

The night before, lay out the following:

- Passport + copy of photo page

- Proof of uninterrupted residence (lease, EDF bills, etc.) covering at least 24 months

- Eight payslips + contracts + employer letter (originals & copies)

- Two filled copies of Cerfa 15186-01 signed by the employer

- 38 € timbre fiscal (digital stamp acceptable)

- Two recent ID photos complying with ISO/IEC 19794-5

Arrive 30 minutes early; many prefectures give tokens on a first-come, first-served basis. If you receive an “avis complémentaire” requesting more documents, you usually have 30 days to supply them.

7. What happens after submission?

- Receipt (récépissé) or APS (autorisation provisoire de séjour) often valid for 4–6 months.

- Verification stage: Prefecture may contact URSSAF and the labour inspection (DDETS) to confirm salary declarations.

- Employer’s tax payment: Within 30 days of the prefecture’s positive opinion, your employer must pay the OFII tax (55 % of monthly gross salary, capped).

- Card issuance: Once OFII confirms payment, the prefecture prints your one-year salarié card.

If you receive a negative decision or an OQTF (order to leave), act fast: you have 30 days to lodge an appeal with the administrative court. Professional assistance is strongly recommended.

Frequently Asked Questions (FAQ)

Do interim payslips count toward the eight?

Yes. Attach each assignment contract to prove continuity and add a summary table of dates and hours.

What if I only have digital payslips?

Print them, have HR stamp them “Conforme à l’original,” and sign each page. Prefects now routinely accept properly certified digital copies.

Can I combine payslips from two different employers?

Yes, provided the slips collectively cover at least eight months. Include both contracts and a letter from each employer.

Is it possible to regularize with fewer than eight slips?

Rarely. Some prefectures consider 6–7 payslips if backed by strong tax filings and a long work history. Legal counsel is advisable.

How long does the whole process take in 2025?

Currently 4–8 months in Île-de-France, 2–4 months in smaller prefectures, according to service-public.fr statistics updated March 2025.

Ready to secure your future in France? ImmiFrance’s lawyers have handled hundreds of work regularization files with a 92 % success rate. Book a confidential review today and let us turn your eight payslips into a residence permit.

Get personalized assistance now