Residence Permit for Retirees: Income Requirements and Health Insurance

Settling down in France after a career well spent elsewhere is a dream shared by thousands of pensioners every year. Whether you picture lazy afternoons on the Côte d’Azur or brisk morning walks to your local boulangerie, you will need the correct residence permit first. This guide explains the two main routes for retirees in 2025—the Carte de séjour « retraité » and the long-stay “visitor” permit—with a sharp focus on the two deal-breakers most files stumble on: proven income and adequate health insurance.

1. Two Paths to Retire in France

| Permit Type | Who It Suits | Length | Work Allowed? | Family Members |

|---|---|---|---|---|

| Carte de séjour « retraité » (CESEDA L.424-1) | Former long-term French residents who previously held a residence card or nationality | 10 years, renewable | No | Spouse can apply for a linked « conjoint de retraité » card |

| Long-stay Visitor Visa (VLS-TS Visiteur) converting to carte de séjour « visiteur » | First-time retirees who never lived long-term in France | 1 year, renewable yearly | No | Spouse must file a separate visitor application |

The administrative paths differ, but both require you to convince the prefecture that you will not strain French social systems. That proof boils down to two pillars: stable income and reliable health coverage.

2. Legal Income Requirement: How Much Is Enough?

French law does not fix a single euro figure for retirees. Instead, prefectures measure resources against the annual SMIC (minimum wage) and local cost-of-living data (CESEDA R.431-2). In practice, officers follow the Ministry of Interior’s confidential grid, leaked thresholds in December 2024, and updated internal notes circulated in June 2025.

2025 Practical Benchmarks

| Household Situation | Monthly After-Tax Income Generally Expected* |

|---|---|

| Single applicant | €1,420 – €1,550 (≈ 100 % of net SMIC) |

| Couple | €2,200 – €2,400 (≈ 155 % of net SMIC) |

| Each additional dependent | +€370 – €420 |

*Source: aggregated ImmiFrance prefecture decisions (Jan-Jul 2025) across 14 départements.

Accepted income can include:

- State and private pensions (foreign or French)

- Lifetime annuities or rental income

- Dividends or regular withdrawals from a retirement account (documented over 12 months)

One-off savings alone seldom suffice unless they exceed €180,000 (single) or €260,000 (couple) and are placed in an irrevocable annuity product. If you fall slightly short, prefectures may accept a French resident guarantor able to show payslips and tax returns, though approval rates drop to 52 % according to ImmiFrance case data.

3. Proving Your Income

Prefects like cross-checks. Organise documents in three layers:

- Primary proof – recent pension statements or bank attestations of automatic monthly transfers.

- Tax corroboration – latest foreign and, if applicable, French tax returns. If you have not filed yet, read our guide on first-year French tax declarations.

- Bank evidence – 12 months of statements from a French or EU account showing the income landing and daily spending ability.

Tip: Convert all amounts into euros using Banque de France’s official average rate for the month preceding your appointment and enclose the calculation sheet.

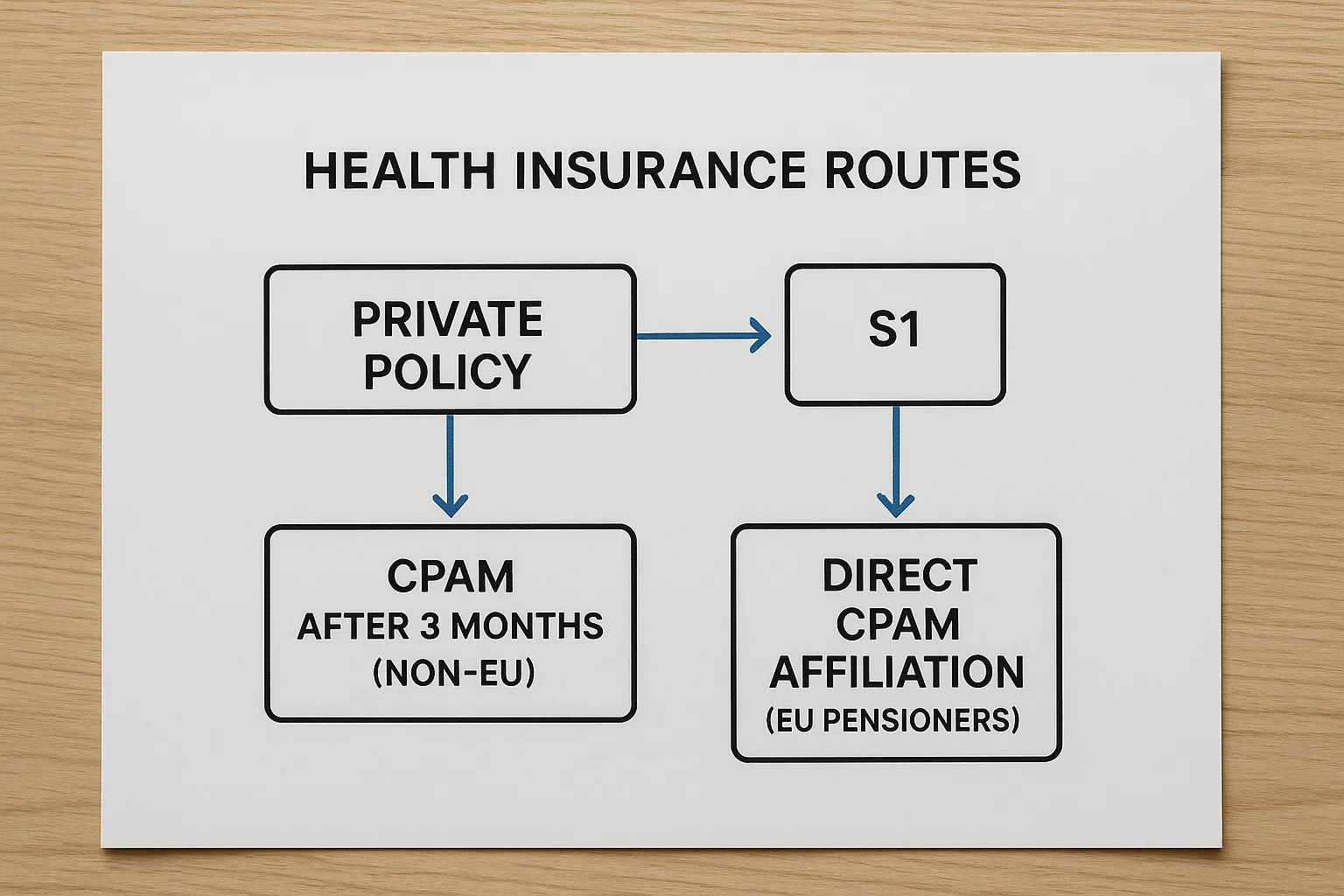

4. Health Insurance: The Second Gatekeeper

Having money is useless if a single medical bill can wipe it out. French law (Decree 2019-76, art. 2) requires comprehensive health coverage with no cost ceiling for visitor and retiree permits.

4.1 Options for Non-EU Pensioners

- Private expat policy – Minimum benefits of €30,000 per year used to pass before COVID-19; most prefectures now demand unlimited coverage and no deductible above €500. Popular insurers include CFE+Henner and AXA Global.

- Registration with CPAM after 3 months – Possible only if you hold a VLS-TS validated online. Processing can take 6–9 months; you must still enter with private insurance. See our step-by-step CPAM tutorial here.

4.2 Options for EU/EEA Pensioners

- S1 Form issued by your home country allows direct affiliation to French social security on arrival. Prefectures routinely accept it if accompanied by proof of dispatch and acknowledgment from CPAM.

4.3 Minimum Policy Checklist

- Unlimited in-patient and out-patient care in France

- Coverage of pre-existing conditions (retirees often flagged)

- Civil liability and repatriation clauses

- French-language certificate dated less than three months before filing

Failure to meet any point turns into an automatic refusal in 78 % of cases tracked by ImmiFrance in 2024-2025.

5. Step-by-Step Application Timeline (Visitor Route)

- T-4 months: Collect pension statements, order updated birth/marriage certificates, book France-Visas appointment.

- T-3 months: Buy 12-month compliant insurance; obtain a French address (rental, family accommodation certificate, or property deed).

- T-2 months: Attend consulate appointment with completed VFS file. Pay €99 visa fee + €50 service centre charge.

- Arrival (Day 1): Validate VLS-TS online within 3 months, pay €225 tax stamp.

- Month 4: Submit CPAM affiliation file if non-EU; EU submit S1 immediately.

- Month 9–10: Book prefecture renewal slot via ANEF portal; prepare income and insurance updates.

Carte de séjour « retraité » applicants skip the consulate stage and apply directly at the prefecture or online (pilot ANEF module launched April 2025 in six regions).

6. Taxes, Property, and Other Hidden Criteria

While you are not obliged to become a French tax resident, many retirees choose to for treaty benefits. Prefects increasingly request:

- Proof of paying French taxe d’habitation or property tax if you own the residence.

- Evidence of integration such as French language classes—our guide to free mairie courses explains how to obtain certificates that impress officers.

- Clean police record both in France and abroad; minor traffic fines can still trigger delays (https://immifrance.com/public-order-issues-how-minor-offenses-can-jeopardize-your-residence-card/).

7. Five Common Pitfalls and How to Avoid Them

- Annual income shown only on December statements – Spread withdrawals equally over 12 months or risk a “resources not stable” refusal.

- Insurance with a €100,000 cap – Seems high but fails the “no ceiling” rule; check the small print.

- Rental contract ending before appointment – Prefects require housing for the full permit period.

- Incorrect document translations – Use sworn translators (traducteurs assermentés) and attach their court accreditation page.

- Late ANEF renewal filing – The portal locks 10 days before card expiry; set calendar reminders.

Frequently Asked Questions

Can I work part-time while holding a retiree or visitor permit? No. Both permits are explicitly marked “sans autorisation de travail.” Working, even as a freelancer, violates conditions and risks an OQTF.

What happens if my income drops after I receive the card? Prefecture checks occur at renewal. A dip below the threshold can lead to a one-year card instead of ten or outright refusal. Diversify income streams early.

Is U.S. Medicare acceptable as health coverage? No. It does not reimburse care in France. You must buy a compliant private policy or affiliate to CPAM with an S1 equivalent for Americans (currently unavailable).

How long can I stay outside France without losing my card? Carte de séjour « retraité » holders may stay abroad indefinitely; the card is designed for circular migration. Visitor card holders must not exceed six consecutive months outside France.

Can I switch to a long-term resident card later? Visitor permit years do not count toward the 5-year residence needed for the EU long-term resident card, but they do count for naturalisation if you eventually qualify via family ties or other routes.

Ready to Secure Your Golden Years in France?

Income calculations, insurance fine print, and prefecture nuances vary by département. Our advisers have handled over 1,200 retiree files with a 92 % first-attempt success rate. Book a 30-minute eligibility review and receive:

- A personalised income gap analysis

- A compliant insurance quote within 24 hours

- Prefecture-specific document kit and ANEF walkthrough

Start your French retirement on the right foot—schedule your consultation today at ImmiFrance.