Understanding the Public Health Insurance Contribution for Visa Holders

France’s promise of universal health coverage extends to most foreign nationals living in the country, but it is not completely free. If you hold a long-stay visa or a residence permit and you are not paying French payroll or self-employment contributions, you may receive a bill from URSSAF for the “contribution to public health insurance” (cotisation subsidiaire maladie, or CSM). Many newcomers are surprised to discover this obligation months after registering with CPAM, and unpaid CSM can jeopardise both reimbursements and future immigration applications. This guide explains in plain English how the contribution works in 2025, who must pay, how much it costs, and how to stay compliant.

1. Why does the CSM exist?

Under the Protection universelle maladie (PUMa) system introduced in 2016, anyone who resides in France on a stable and regular basis for at least three months is entitled to join the state health insurance scheme. For salaried workers and most freelancers, contributions are deducted automatically through payroll or URSSAF declarations.

For people with no professional income in France—typical cases include retirees, accompanying spouses, digital nomads on savings, and some jobseekers—the French social-security budget still needs to be financed. Article L.380-2 of the Social-Security Code therefore created the CSM: an annual contribution calculated on household income, collected by URSSAF.

2. Visa holders most commonly affected

You may be liable for the CSM if all of the following apply:

- You hold a long-stay visa (VLS-TS) or residence card and have registered with CPAM.

- You have lived in France for at least one full calendar year.

- You are not an employee, civil servant, self-employed worker registered with URSSAF, pensioner affiliated to a French scheme, or beneficiary of certain social allowances.

- Your 2024 taxable household income in France exceeds the legal threshold (€10 284 for 2025).

Typical ImmiFrance clients who receive a CSM notice include:

- International students who switch to a visitor status after graduating and take a gap year.

- Spouses of Passeport Talent holders who do not work.

- Remote employees paid by a foreign company without a French payroll.

- Digital nomads on savings who registered for health coverage to obtain a carte Vitale.

Key exemptions

The following categories are currently exempt (Article D.380-1 CSS):

- Students under 28 and doctoral researchers with a valid student card.

- Jobseekers receiving French unemployment benefits (ARE).

- Beneficiaries of RSA, AAH, ASPA or a pension under €20 568 (single person).

- Asylum seekers and holders of AME (free state medical aid).

- Households whose revenu fiscal de référence (RFR) is below €10 284.

3. How much will you pay in 2025?

The CSM is 8 % of your RFR above the annual threshold. The calculation uses the RFR shown on your latest French tax assessment (avis d’imposition).

| Example scenario (2025 assessment) | Amount |

|---|---|

| Household RFR (2024 income) | €28 000 |

| Threshold (2025) | €10 284 |

| Taxable base | €17 716 |

| Rate | 8 % |

| 2025 CSM due | €1 417.28 |

The contribution is capped at double the annual social-security ceiling (PASS) and adjusted pro rata for part-year residence. Couples file a single declaration: if one spouse has French wages, the household is exempt even if the second spouse is inactive.

4. Declaration and payment timeline

URSSAF opens the online declaration each July. For 2025 the key dates are:

- 15 July 2025: declaration platform opens.

- 30 September 2025: deadline to submit the form and pay, or set up monthly instalments.

- 31 December 2025: interest of 5 % applies to unpaid balance.

Step-by-step online filing

- Obtain your French tax ID (numéro fiscal) and activate an impots.gouv.fr account if you have not already.

- Create or log in to your autoentrepreneur.urssaf.fr / csm space with your social-security number.

- Confirm your civil status and French address.

- Import your RFR automatically or type it manually from your 2025 tax notice.

- Indicate any exemptions (student status, RSA, spouse exempt).

- Review the calculated amount and select:

- Single payment (CB/SEPA) by 30 September, or

- 12 monthly instalments starting in October.

- Download the confirmation PDF for your records—prefectures sometimes ask.

5. What happens if you ignore the CSM?

- Suspension of benefits: CPAM can freeze reimbursement of medical expenses until proof of payment is provided.

- Penalties: URSSAF applies late-payment interest (5 %) and a 10 % surcharge if no declaration is filed within 30 days after a formal notice.

- Immigration impact: Prefectures increasingly ask for evidence of CSM compliance when renewing visitor, private-life or retired-employee permits, and when assessing naturalisation files under Article 34 of the 2025 Immigration Reform.

6. How to avoid or reduce the contribution

- Switch to salaried status: Even a part-time French contract automatically replaces the CSM.

- Register as a micro-entrepreneur: You will pay simplified social contributions on turnover instead of CSM on global income. ImmiFrance’s dedicated guide explains the process (see our internal link).

- Optimise household income: Certain foreign pensions, scholarships and capital gains can be excluded from French taxable income if eligible under bilateral tax treaties. Consult a tax adviser.

- Check exemption thresholds annually: The ceiling is indexed; a small donation or deductible expense may bring RFR below the limit.

- Claim retroactive corrections: If you mistakenly declared yourself liable, you can amend within three years.

7. Connecting the dots: CPAM, taxes, and prefecture files

The CSM sits at the intersection of three French bureaucracies—health insurance (CPAM), social-security collections (URSSAF) and taxation (DGFiP)—and data moves automatically between them. Clean alignment across these databases is crucial:

- Matching addresses avoid returned mail that triggers penalties.

- Timely French tax returns generate the RFR needed for the CSM calculation.

- Payment proofs strengthen renewals of visitor cards, VPF cards and applications for the 10-year resident card.

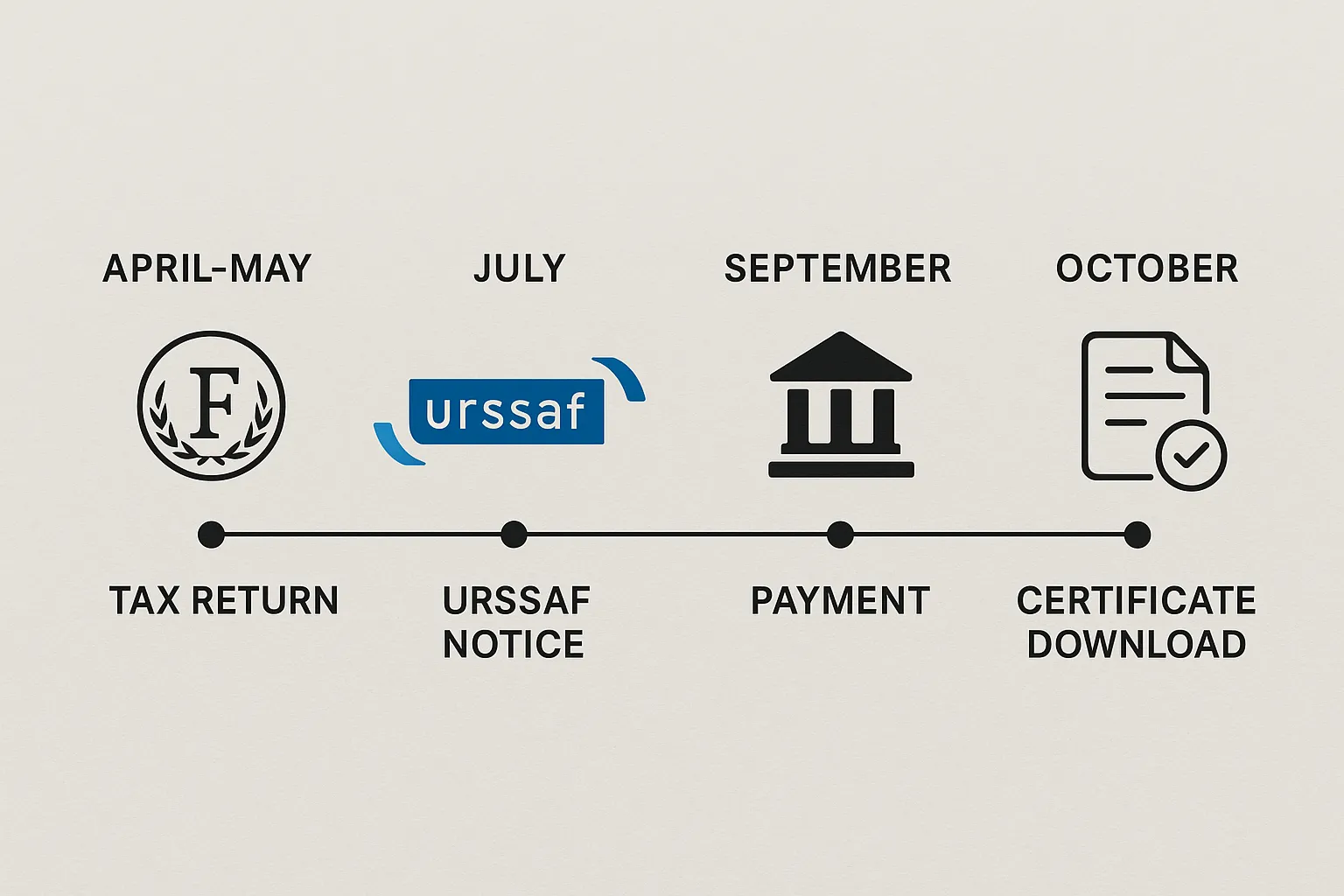

ImmiFrance recommends creating a compliance calendar:

- April–May: file French income-tax return (including zero-income declaration if relevant).

- July: check URSSAF space for the CSM notice.

- September: pay or challenge the assessment.

- October: download payment certificate for your immigration dossier.

8. Table of common situations

| Profile | Working in France? | RFR above €10 284? | CSM due? | Action |

|---|---|---|---|---|

| Student finishing master’s, now on VLS-TS “chercheur d’emploi” | No | €0 | No | Keep student certificate. File tax return. |

| Remote software engineer paid by US employer | No payroll in France | €65 000 | Yes | Declare and pay by 30 Sept or switch to micro-entrepreneur. |

| Retiree with French pension €18 000 | French pension | €18 000 | No | Payroll contributions already deducted. |

| Stay-at-home spouse of Passeport Talent | No | €15 000 | No | Household exempt because spouse has French salary. |

| Visitor permit, real-estate income €22 000 | No | €22 000 | Yes | Declare and pay; keep proof for renewal. |

Frequently Asked Questions

Is the CSM the same as the OFII tax I paid when validating my visa? The OFII tax (currently €200) is a one-time fiscal stamp for visa validation. The CSM is an annual health-insurance contribution collected by URSSAF once you are a resident.

Can I get reimbursed for medical expenses if I have not paid the CSM yet? CPAM can withhold reimbursements after the due date. Pay promptly or provide an exemption certificate to restore benefits.

What if my income dropped this year? The CSM is based on last year’s income. You can request a provisional reduction by uploading proof (payslips, redundancy letter) to URSSAF; the agency may adjust the contribution.

I was abroad for part of the year—do I still owe the full amount? No, the contribution is prorated according to the number of months you spent in France during the calendar year, provided you inform URSSAF in the declaration.

Will unpaid CSM block my naturalisation application? Prefectures routinely check tax and social-security compliance. An unpaid CSM debt can be interpreted as lack of assimilation to French civic obligations and may delay or derail naturalisation.

Need help? ImmiFrance has you covered

The CSM may look like a simple form, yet mistakes—wrong thresholds, missed exemptions, late payments—can cost you hundreds of euros and complicate future residence-permit renewals. Our advisers can:

- Review your CPAM registration and tax status to see if you really owe the contribution.

- Prepare or contest your URSSAF declaration.

- Provide official payment or exemption certificates for your prefecture file.

- Connect you with specialised lawyers if URSSAF has already initiated recovery proceedings.

Book a 30-minute video consultation today at immifrance.com/consultation and secure your health coverage and immigration status in one go.