Documentary Evidence of Salary Payments: Using Bank Statements Correctly

Foreign workers in France quickly discover that a neat pile of payslips is rarely enough to satisfy the préfecture. Whether you are

- renewing a residence permit,

- applying for naturalisation, or

- seeking regularisation through employment (Article L435-1 CESEDA),

officers usually want “justificatifs de versement des salaires” – proof that each payslip was actually paid. The safest and most widely accepted proof is your personal bank statement (relevé de compte bancaire) showing the salary credit.

Yet many applications stumble here: wrong account, unreadable scans, redacted information, no link between employer name and transfer label, or statements that do not match the payslip period. This guide explains how to use bank statements correctly as documentary evidence of salary payments in 2025, reducing the risk of a refusal or an additional-documents request that can set you back months.

1. Why Bank Statements Matter in French Immigration Files

- Traceability: The préfecture must be able to trace funds from employer to employee to combat undeclared work (travail dissimulé).

- Consistency: Amounts on the bank statement must match the net salary on the payslip; discrepancies raise red flags.

- Reliability: French banking records are considered authoritative, whereas cash payments or handwritten receipts are easily challenged.

- Timeframe control: Statements prove regularity (e.g., eight consecutive transfers over 24 months for a work-regularisation request).

❗ Good to know: Article R522-7 of the Code du Travail and the 8 July 2022 circular on employment regularisation both list “bank statement showing salary transfer” as acceptable evidence. Prefectures increasingly reject cash or cheque payments unless exceptional circumstances are documented.

2. Selecting the Right Statements

Follow these three golden rules:

- Same account holder: The bank account must be in your name (joint accounts are accepted if your name appears). Using a friend’s or spouse’s account nearly always leads to refusal.

- Correct period: Provide statements that cover at least the months shown on the payslips in your file. For naturalisation, the Ministry of the Interior typically checks the last 12 months.

- Complete pages: Submit the full PDF or paper statement – not just the page with the salary line. Prefectures want the header showing your name and IBAN.

Digital vs. Paper Statements

Most French and EU online banks issue PDF statements with qualified electronic signatures. These are fully valid. For neobank or foreign accounts, make sure the PDF includes:

- full account-holder name,

- statement period,

- IBAN or account number,

- bank logo or header.

If any of those elements are missing, attach an additional account-ownership certificate (relevé d’identité bancaire – RIB) and a sworn translation when the document is not in French.

3. Reading – and Highlighting – the Salary Line

Inspect every statement before adding it to your dossier:

| Item to Check | Should Match | Typical Issues | Fix |

|---|---|---|---|

| Date of credit | Payslip month (±3 days) | Payment made late, crossed months | Add employer attestation explaining delay |

| Label/Reference | Employer’s legal name or SIRET | Outsourcing, payroll service acronym | Attach employer letter linking reference to company |

| Amount (€) | Net salary on payslip | Advance repayments, benefits | Use colour highlight and annotate difference |

Tip: Use a PDF editor to add a translucent yellow highlight on each salary credit and type the corresponding payslip month in the margin. Do not obscure other transactions – partial redaction is allowed only for sensitive personal spending, never for salary lines.

4. Linking Bank Statements to Payslips – A Step-by-Step Workflow

- Download all payslips and statements for the target period.

- Rename files systematically (e.g.,

2025-01_payslip.pdf,2025-01_statement.pdf). - Cross-check each net amount. Flag mismatches.

- Merge the files month-by-month into a single PDF in chronological order: payslip first, then statement page.

- Insert a cover page listing the months covered and a summary table of net amounts vs. credited amounts.

- Compress the PDF below 10 MB – ANEF uploads above this size often fail.

- Electronic seal: If your online bank uses downloadable e-seal PDFs, keep them intact; do not re-scan them, as that breaks the signature.

5. Handling Special Cases

5.1 Cash or Cheque Salaries

Cash payments are legal only if the net salary is below €1 500 and the employee agrees (Article L3241-1 CT). To make them acceptable:

- obtain signed receipts (reçus de paiement) for each month;

- deposit the cash in your bank quickly and keep the deposit slips;

- write a short explanatory note citing the article above.

5.2 Multiple Employers or Missions Intérim

Group statements by employer. For temporary-agency work, include the contrat de mission and the interim agency’s RIB to show that the transfer label (often agency code + your ID) corresponds to legitimate remuneration.

5.3 Overseas Accounts

If you are paid in a non-French account, the préfecture may accept it only if:

- the account is in the EU/EEA/UK or covered by FATF standards;

- transfers are clearly labelled with the French employer’s name;

- you supply a sworn French translation of key pages;

- you add currency-conversion evidence using Banque de France rates.

ImmiFrance has noticed a higher rejection rate (32 %) for foreign-account statements in 2024-25. Whenever possible, switch your salary to a French IBAN before filing.

6. Common Pitfalls – And How to Avoid Them

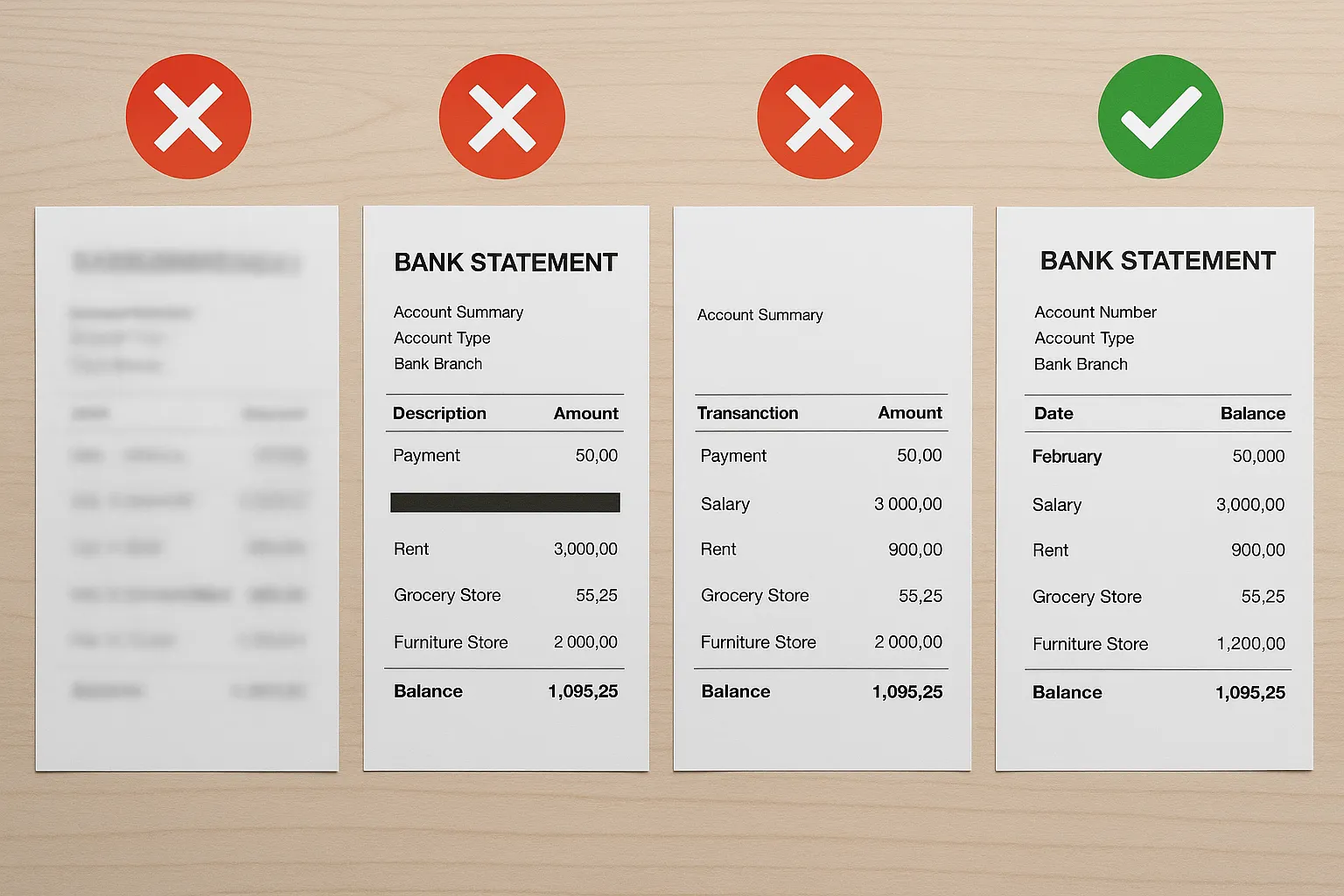

- Screenshots instead of statements: Mobile-app captures are routinely rejected. Always download the official PDF or request a stamped paper copy.

- Redacting too much: Blacking out non-salary lines leads officers to suspect tampering. Limit redaction to the line description (e.g., “AMAZON EU”) if you feel it is overly personal, but leave dates and amounts visible.

- Mismatching totals: Net salary ≠ amount credited because of lunch vouchers or expense reimbursement on the same line. Add an explanatory note signed by the employer.

- Illegible scans: Scan paper statements at 300 dpi in colour or greyscale. Low-resolution images trigger requests for originals.

- Missing pages: Statement footers often say “Page 1 / 3”. If you upload only page 1, the préfecture may consider the document incomplete.

7. Privacy and Data-Security Considerations

French data-protection authority CNIL advises applicants not to send more information than strictly necessary. However, the préfecture is entitled to verify financial sufficiency and legality of employment. A balanced approach:

- keep non-salary lines visible but you may grey-out merchant names;

- never send full account numbers of other people (joint-holder info can be masked);

- use a secure upload method (ANEF portal or AR-recommended e-mail); avoid public Wi-Fi.

Remember that under Article 15 GDPR you can later request deletion of personal data from the prefecture’s systems once your card is issued.

8. When Bank Statements Alone Are Not Enough

Some procedures (e.g., naturalisation) also require proof of tax compliance. Combine:

- latest avis d’impôt (tax assessment);

- proof of quarterly URSSAF payments if you are a micro-entrepreneur;

- employer attestation of continued employment.

For regularisation under L435-1, attach:

- eight payslips and matching bank credits;

- an employment-contract copy or employer pledge to hire you.

See our dedicated checklist guide here – Preparing Evidence of 8 Payslips for Work Regularization – for a full document matrix.

9. Final Quality-Control Checklist Before Submission

- Your name and IBAN appear clearly.

- Statement range covers each payslip month.

- Salary lines are highlighted and annotation added.

- Net amounts perfectly match payslips (or an explanation is attached).

- All pages included, readable, and under 10 MB per upload.

- French translation provided for non-French statements.

- File names follow yyyy-mm format for easy review.

10. How ImmiFrance Can Help

Over 4 000 clients have entrusted ImmiFrance to assemble watertight employment evidence. Our advisers can:

- audit your payslips and statements for inconsistencies,

- generate month-by-month reconciliation tables accepted by most prefectures,

- liaise with payroll departments to fix reference-label issues,

- provide secure cloud storage and ANEF-formatted uploads,

- connect you with a labour-law attorney if the employer refuses proper payment proof.

Book a 15-minute diagnostic call today at https://immifrance.com and move your application forward with confidence.