Diplomatic passport holders often enjoy smoother entry formalities than ordinary travellers, but the exact rules change regularly as France revises its bilateral agreements. Below you will find the up-to-date 2025 list of countries whose diplomats can enter metropolitan France (and the wider Schengen area) without applying for a short-stay C visa, plus practical tips to avoid unpleasant surprises at the border.

Why Diplomatic Passport Waivers Exist

A diplomatic passport is not automatically a visa substitute. France waives short-stay visa requirements only when one of the following applies:

- A bilateral agreement between France and the sending State specifically exempts diplomatic and/or service passport holders.

- The EU common visa list (Regulation EU 2018/1806, Annex II) already waives visas for all nationals of that third country, regardless of passport type.

Because each agreement spells out its own scope and conditions, keeping track of yearly revisions is essential—especially for attachés arriving with family members who may hold ordinary passports.

According to a July 2025 circular from the French Ministry for Europe and Foreign Affairs (MEAE), 58 countries currently benefit from a diplomatic short-stay visa waiver.

2025 Visa-Waiver Countries for Diplomatic Passports

The table below consolidates the MEAE circular and the most recent bilateral notes verbales. All waivers grant up to 90 days in any 180-day period (Schengen calculation) unless otherwise stated.

| Region | Country (Diplomatic — also Service?) | Agreement Reference | Notes |

|---|---|---|---|

| Africa | Algeria (D only) | 1968 Franco-Algerian Accord, Art. 6 | Entry limited to official duty |

| Morocco (D & S) | Decree 2008-372 | Biometrics still taken on first entry | |

| Tunisia (D & S) | Decree 85-1284 | — | |

| South Africa (D & S) | Exchange of Notes 04/2019 | — | |

| Americas | Brazil (D & S) | Decree 99-310 & 2005 addendum | Family members on ordinary passports need visas |

| Canada (all) | EU Annex II list | Ordinary passports already visa-exempt | |

| Mexico (D & S) | Decree 2004-193 | — | |

| Asia–Pacific | Australia (all) | EU Annex II | — |

| China (D & S) | Agreement 20 Oct 2019 | Max 30 days per visit | |

| India (D only) | Bilateral MoU 2016, renewed 2024 | Service passports still need visas | |

| Japan (all) | EU Annex II | — | |

| Europe | United Kingdom (D only) | Exchange of Notes 2021 | Post-Brexit arrangement |

| Serbia (D & S) | EU Annex II | — | |

| Ukraine (D only) | Interim Agreement 2022 | Valid only for biometric passports | |

| Middle East | Qatar (D & S) | Agreement 2018-XII-7 | Length of stay capped at 60 consecutive days |

| United Arab Emirates (D & S) | Agreement 2015 | — | |

| Saudi Arabia (D & S) | Agreement 2013, updated 2025 | — |

D = diplomatic passport, S = service/official passport.

A complete point-by-point list, including smaller island States and newly independent nations, can be downloaded from the official MEAE portal.

New in 2025

- Rwanda added to the list (ministerial decree of 12 May 2025).

- Philippines service-passport holders now also waived, aligning with diplomatic holders.

- Russia suspension of the 1967 agreement remains in force—diplomatic passports again need visas.

Conditions to Benefit from the Waiver

Even with an agreement in place, border officers will still check:

- Purpose of stay: mission order, accreditation letter or official note verbale.

- Passport validity: at least three months beyond the intended departure from Schengen.

- Insurance & funds: rarely requested for diplomats but legally admissible under the Schengen Borders Code.

- 90/180-day compliance: overstays lead to registre des personnes recherchées alerts and may jeopardise future accreditation.

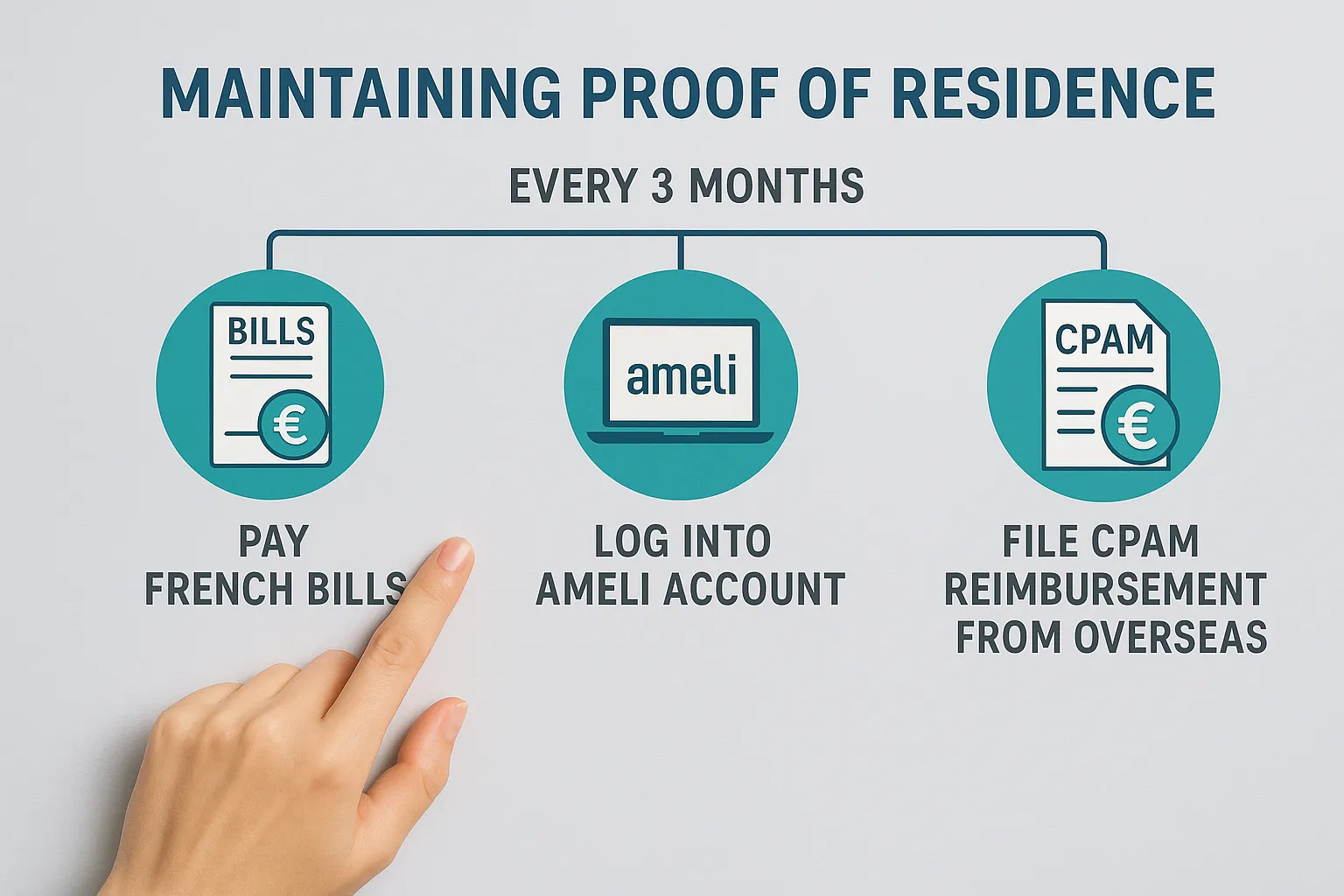

Diplomats posted to France for longer than 90 days must still request a special carte de séjour “agent diplomatique” from the Protocole department of the Ministry of Foreign Affairs—not from the préfecture.

Common Pitfalls We See at ImmiFrance

- Mixed-passport families. A spouse on an ordinary passport often forgets to secure a separate C visa, resulting in refused boarding.

- Old-style service passports. Some countries issue service passports not machine-readable, triggering Article 8 of the Visa Code—airlines may deny boarding.

- Multiple short trips. Counting days incorrectly is widespread. Use the Commission’s online calculator or our free Schengen-day tracker.

- Mission change mid-trip. Switching from an official mission to tourism invalidates the waiver; officers may stamp tourisme and reset your calculation.

What Happens if You Need a Visa After All?

If your circumstances fall outside the waiver—e.g., carrying a service passport where only diplomatic is exempt—you must apply for a short-stay visa via France-Visas. Processing for diplomatic passports is often expedited (two to five working days) once the French embassy receives a note verbale.

Those arriving for longer postings should proactively request their carte de séjour Protocole appointment to avoid gaps in legal stay. See our detailed guide on residence-permit renewal during overseas travel for transit scenarios.

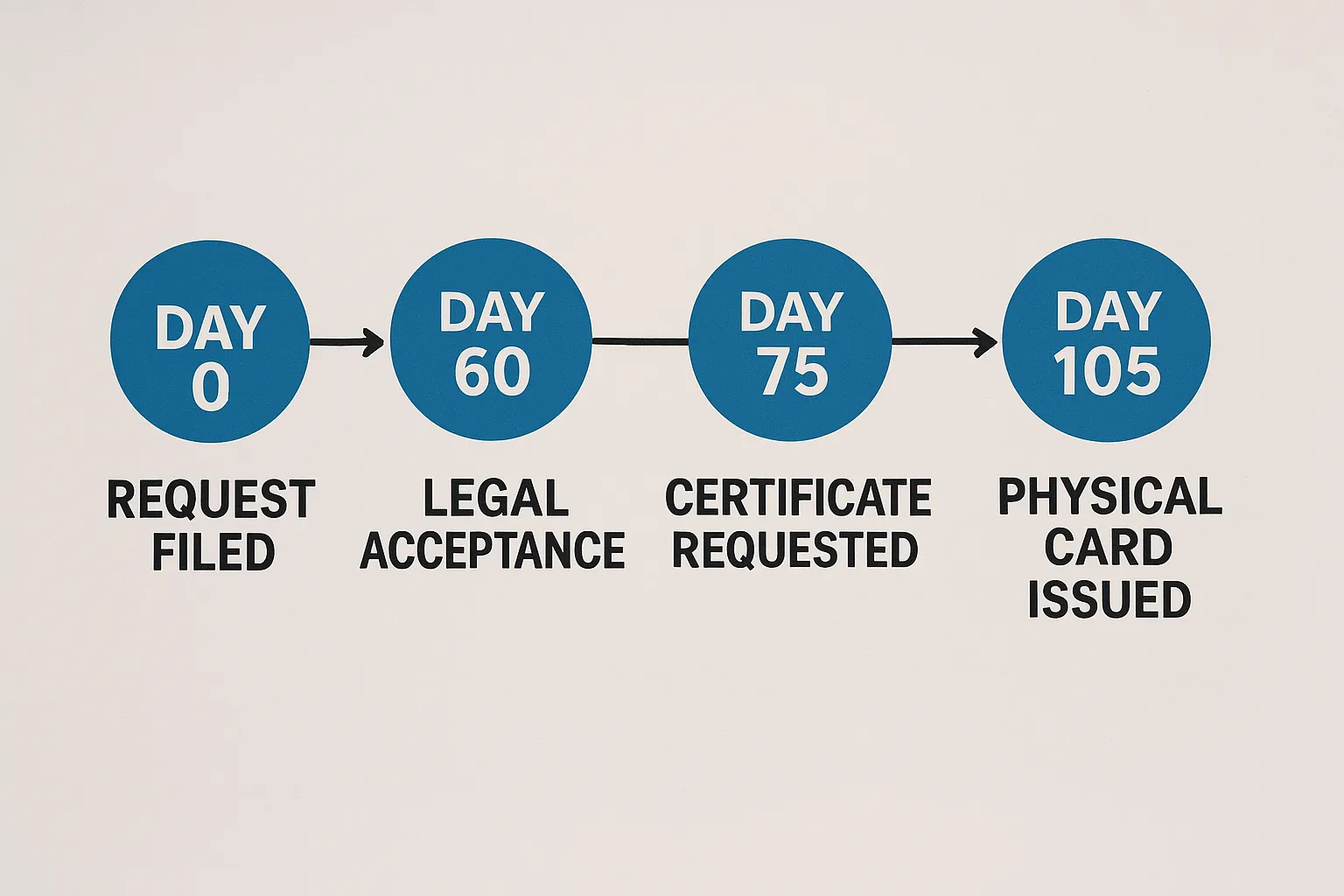

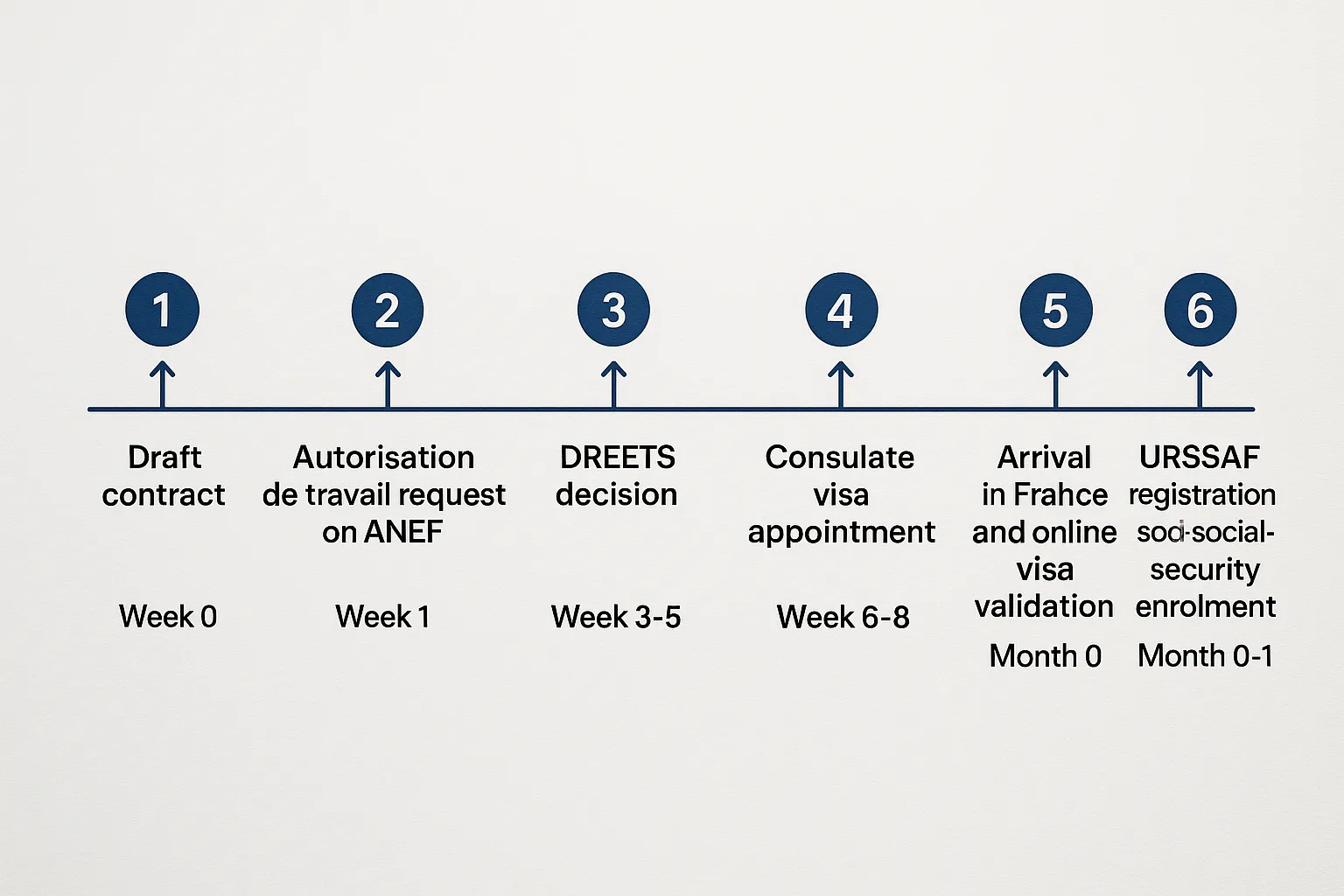

Timeline Checklist Before Departure

- 30 days out: confirm your country’s inclusion on the 2025 waiver list.

- 10 days out: obtain a mission order and scan it to your cloud drive.

- 3 days out: verify passport validity and unused Schengen days (≤ 90 in rolling 180).

- Day 0: carry original note verbale and travel insurance certificate.

Following these steps dramatically reduces secondary inspections at CDG, Orly or Marseille airports.

Frequently Asked Questions

Do diplomatic passport holders pass through the same Schengen lanes as tourists? Yes, but dedicated “Passeports diplomatiques” desks exist at CDG Terminal 2E and some regional airports during busy periods.

Can I combine the waiver with a private family visit? Only if the principal purpose of entry is official. Purely private visits require the standard C visa, even for diplomats.

Does the 90/180 rule reset when I travel to French overseas territories? No. Guadeloupe, Martinique, Réunion and other DROMs apply separate visa policies. Check local exemptions beforehand.

My ordinary-passport spouse holds a valid multi-entry Schengen visa. Do the 90/180 days pool with mine? No. Each person’s days are counted separately; your diplomatic waiver does not grant extra days to family members.

Where can I verify if my country has been added or removed? Consult the MEAE Direction du Protocole website or ask your embassy’s consular section. ImmiFrance monitors updates and can notify you automatically.

Need Personalised Assistance?

Travelling on diplomatic status should be seamless, yet last-minute changes, mixed-status families or expired passports can create headaches. ImmiFrance offers confidential, same-day consultations to:

- Double-check your eligibility for the 2025 visa waiver;

- Book priority France-Visas appointments when a waiver does not apply;

- Prepare supporting notes verbales and mission letters;

- Liaise with the Protocole residence-permit desk for long-term postings.

Ready to secure hassle-free entry? Book a 30-minute strategy call with an ImmiFrance expert now and travel with confidence: https://immifrance.com