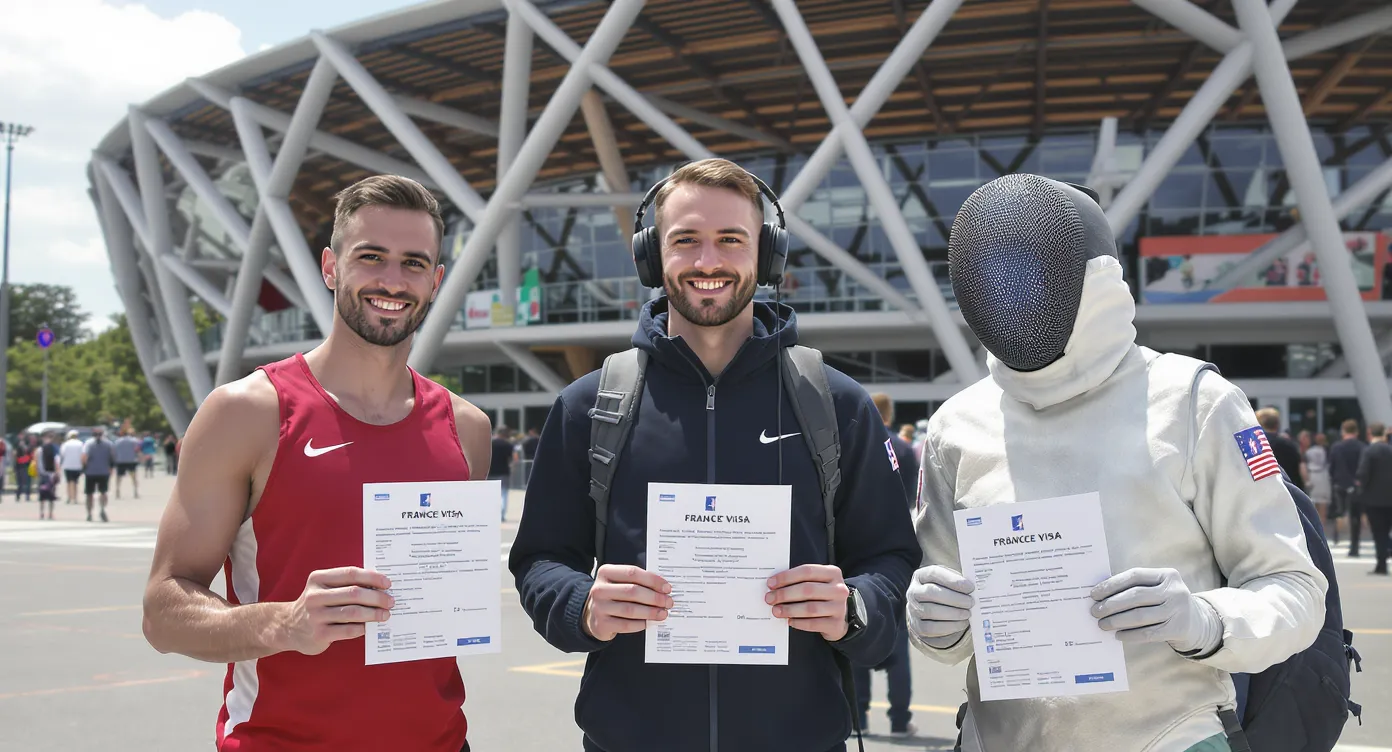

Relocating to a quiet corner of France appeals to many newcomers who dream of stone farmhouses, local markets and a slower pace of life. Yet rural living also introduces a few administrative and practical wrinkles that city guides rarely mention. The checklist below walks you through both the immigration formalities and the day-to-day integration steps that matter when your nearest prefecture or bank branch may be an hour’s drive away.

Use this guide as a roadmap from the moment you start planning your move until the day you feel fully settled in your village. Where a task is complex or time-sensitive, we flag the ImmiFrance service that can save you trips, delays and costly mistakes.

1. Confirm Your Immigration Route and Rural Proof of Address

Many residence-permit categories allow you to live anywhere in France, but some (for example, the Student visa) assume proximity to a university town. When choosing a rural address:

- Check that the commune belongs to the same département as the prefecture handling your application. Sub-prefectures in smaller towns no longer issue most residence cards after the 2025 digital reform, so you may need to travel to the main préfecture for biometrics.

- Ask the seller or landlord for an Attestation d’hébergement or a recent taxe foncière bill in their name; you will need it for France-Visas, ANEF and CPAM filings.

- Keep utility start-up emails (electricity, internet) as backup proof if the prefecture questions the legitimacy of a “remote” address.

ImmiFrance offers a Rural Address Audit that checks whether a chosen village creates red flags for your permit type and helps you pre-assemble acceptable proof of domicile.

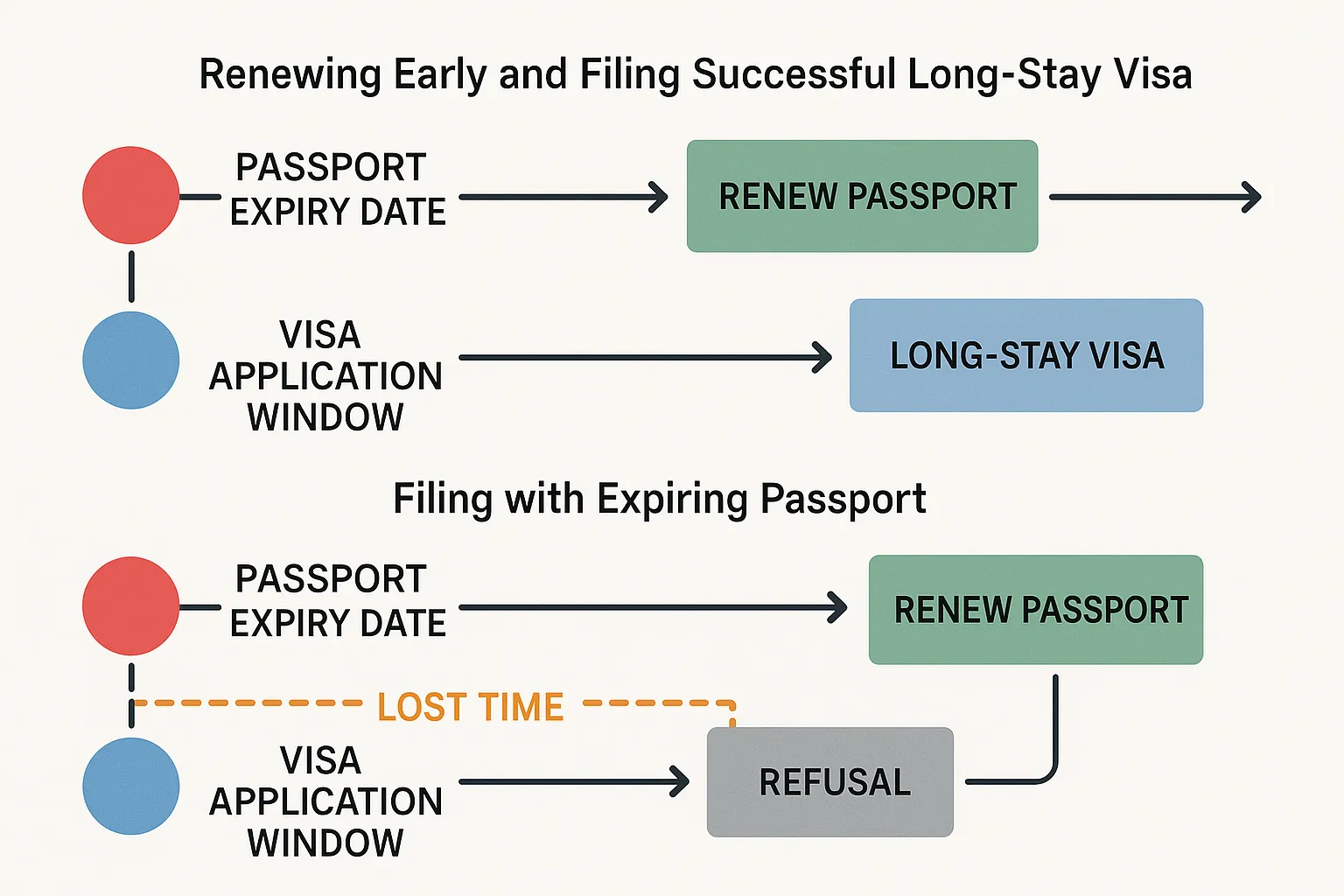

2. Timeline of Key Administrative Steps

Rural newcomers often underestimate travel times and appointment scarcity. Use the table below to plan the first 12 months.

| Month | Procedure | Where It Happens | Processing Time | Internal Resource |

|---|---|---|---|---|

| 0 | Long-stay visa application | Consulate / VFS | 2–4 weeks average | — |

| 1 | OFII online validation | Home computer (ANEF) | Instant attestation | Understanding the CIR |

| 2 | CPAM registration | Mail to CPAM départementale | 6–10 weeks for numéro sécu | Registering with CPAM |

| 3 | FranceConnect+ setup | Online | 10 minutes | Digital FranceConnect guide |

| 4 | First tax return (if arriving in 2024) | Online or paper | May deadline | Tax filing for first-year residents |

| 6 | Driver’s licence exchange (non-EU) | ANTS portal | 3–6 months | Exchange your licence |

| 9 | Local French classes enrollment | Mairie / Association | Varies | Free French classes |

| 10 | Residence-permit renewal prep | ANEF / Prefecture | 60–90 days before expiry | Residence permit renewal guide |

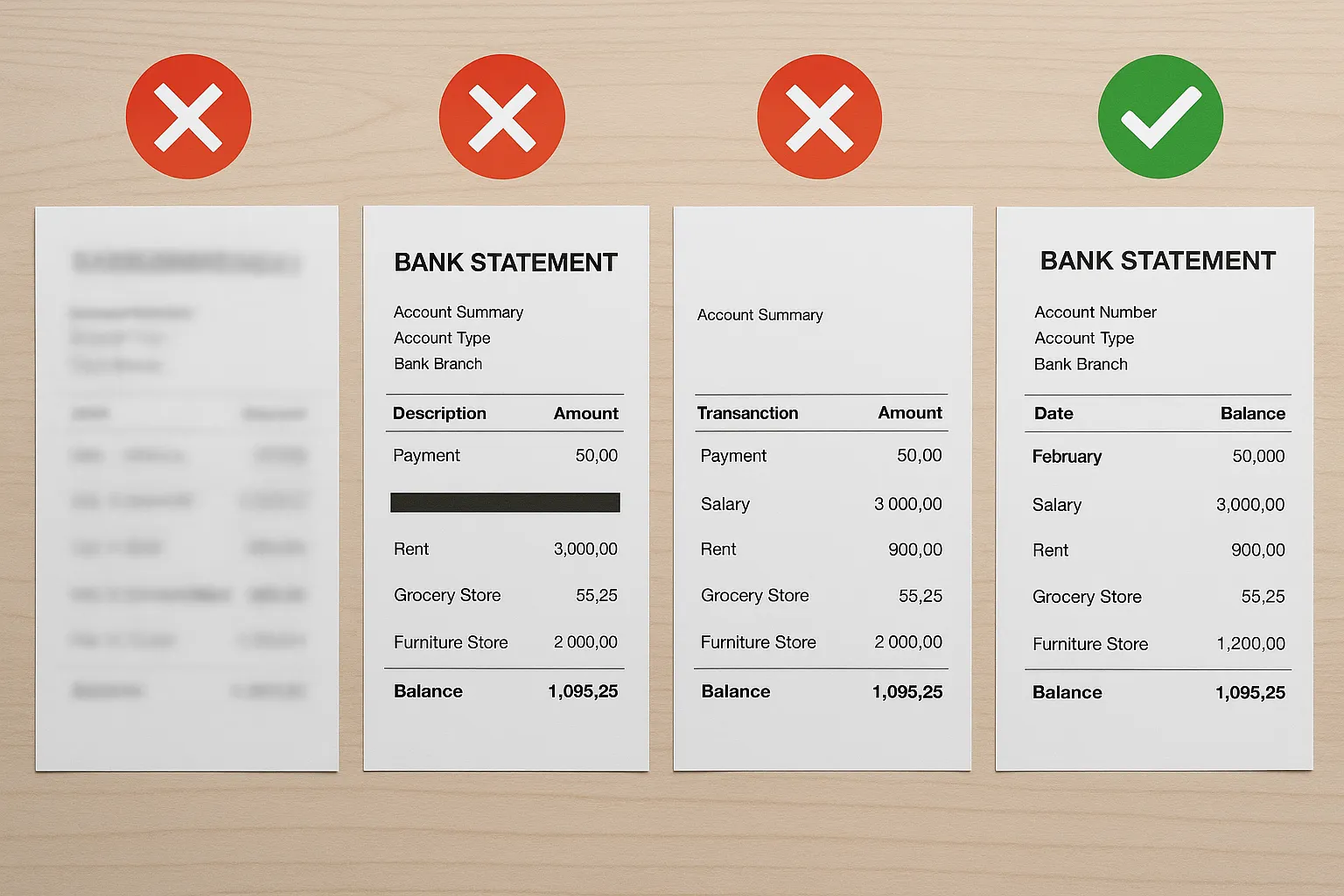

3. Banking and Connectivity Before the Move

Opening a French bank account remotely is crucial in hamlets where physical branches have closed.

- Choose an online bank with a FR IBAN—rural employers and utilities still reject foreign IBANs.

- Order a SIM card or eSIM in advance; some valleys have only one reliable carrier.

- Test internet speeds through the operator’s coverage map if you plan to work remotely.

Read our comparison of remote banking options and KYC pitfalls: Opening a French Bank Account Before Arrival.

4. Healthcare Access When the Doctor Is 30 km Away

- Register with CPAM as soon as you arrive; delays mean paying upfront fees at the médecin traitant and pharmacy.

- Ask the mairie for the list of general practitioners who still accept new patients. Rural medical deserts are real.

- Consider a mutuelle that reimburses mileage to the nearest hospital.

- Keep paper copies of prescriptions during the months when you wait for the Carte Vitale.

ImmiFrance’s Carte Vitale Fast-Track bundle checks your CPAM file for missing pieces and monitors responses so you avoid repeat mailings.

5. Schooling and Childcare in Sparsely Populated Areas

French law guarantees every child a place in school, but villages may have multi-grade classrooms or merged inter-communal schools. Steps to follow:

- Enroll at the mairie first; they deliver a certificat d’inscription for the rectorat.

- If your child needs UPE2A French-support classes, request transport arrangements early.

- Undocumented parents can still register children: follow our parent guide Child Enrollment in French Schools Without Legal Status.

6. Earning a Living: Work Permits and Rural Opportunities

Rural départements feature shortages in agriculture, elderly care, construction and hospitality. Depending on your status:

- Employee route: A local employer may leverage the 2025 shortage-occupation quota. Review The 2025 Quota System for Work Permits.

- Freelance route: The auto-entrepreneur regime fits artisans, translators or remote IT workers. See Auto-Entrepreneur Permit Guide.

- Undocumented route: Admission exceptionnelle au séjour remains possible if you can show 8 rural payslips or strong community integration. Start with the Prefecture Checklist for Work Regularisation.

7. Building Integration Evidence in a Small Community

Naturalisation officers and prefects weigh rural applicants by their anchoring in local life. Collect proof continuously:

- Membership in a sports or cultural association (signed statutes, fees receipt).

- Volunteering certificates from the mairie or local charity.

- French-class attendance sheets; rural OFII modules often occur at the neighbouring town hall.

- Tax receipts and utility bills spanning at least two winters (evidence you actually reside there).

These documents counter scepticism that you only use the address for “administrative convenience.” ImmiFrance’s Evidence Tracker lets you store scans with time-stamped metadata that prefectures accept.

8. Transportation and Mobility Essentials

Public transport outside regional hubs is limited. Plan for:

- Car insurance that covers commuting to another département if you work across borders.

- The 2025 zero-tax incentive for electric-car chargers; some communes reimburse half the cost.

- Mastery of the 90/180 Schengen rule when you cross into Spain or Italy for shopping. Check Traveling Inside Schengen With a French Residence Permit.

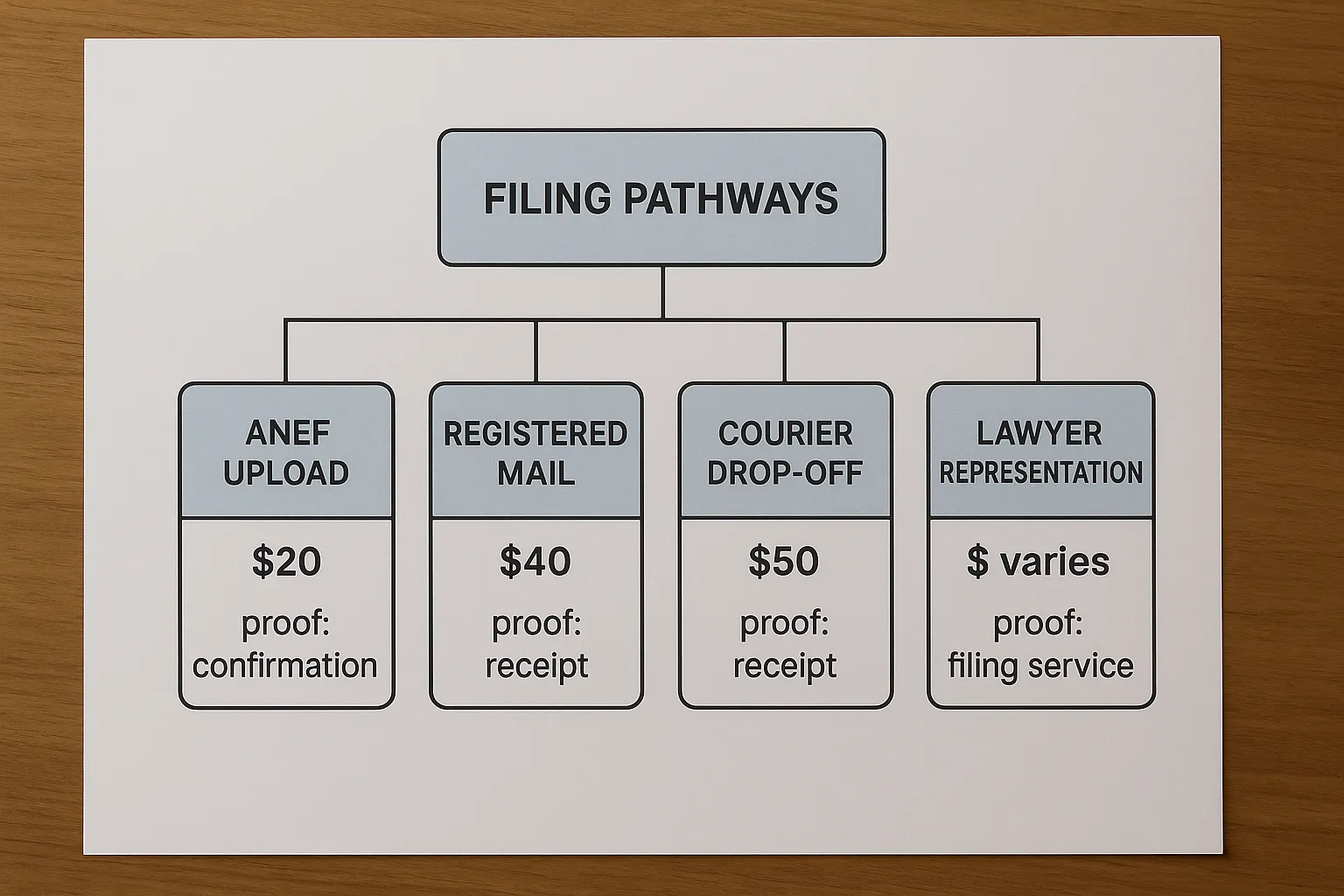

9. Digital Survival Kit When ANEF Goes Offline

Rural fibre cuts or storms can strike on the day ANEF opens your renewal window.

- Save PDF copies of each CERFA draft in case you must switch computers or drive to a library Wi-Fi spot.

- Store FranceConnect recovery codes offline; SMS reception is poor in some valleys.

- Photograph each uploaded document with a timestamp before clicking “validate.” Prefectures sometimes lose files during server maintenance.

ImmiFrance subscribers receive daily ANEF outage alerts and alternative submission instructions.

10. When Things Go Wrong: OQTFs, Lost Mail and Police Checks

Distance does not shield you from prefecture errors. If you receive an OQTF or never get the registered letter inviting you for biometrics:

- Follow our guide Lost Prefecture Mail: Reconstructing Proof of Notification.

- In case of interior police checks on rural roads, carry originals of your residence card plus photocopies of family members’ IDs. See Border Police Checks Inside France.

- Contact ImmiFrance’s 48-hour Appeal Desk to draft an emergency request before the Tribunal administratif.

Frequently Asked Questions

Is a mairie proof of address accepted for all residence-permit applications? A mairie certificat de résidence is useful but the prefecture usually asks for a utility bill less than three months old. Keep both.

Can I renew my permit online if my village has no internet café? Yes, ANEF works from any device. However, you must enroll biometrics in person. ImmiFrance can book the earliest prefecture slot and arrange a mobile fingerprint unit if you qualify under disability rules.

Do I need to exchange my non-EU driver’s licence if I rarely drive? If you are resident, yes. Rural gendarmes perform licence checks during harvest season when accidents increase. Start the online exchange within one year of arrival.

Are free French classes mandatory for the CIR? Only the OFII-assigned hours are compulsory, but mairie courses boost your integration score and help future naturalisation.

What if the local GP refuses new patients? Contact the Conseil départemental de l’Ordre des médecins or the regional health agency (ARS). Show proof you hold a residence permit and CPAM registration. They can assign you a doctor.

Need Hands-On Help With Your Rural Move?

ImmiFrance has guided more than 4 700 applicants who chose village life over big-city buzz. From securing the right visa to chasing a prefecture 120 km away, our advisers and lawyer network handle the red tape while you focus on your new community.

- Rural address and dossier audit

- Prefecture appointment monitoring and document kits

- CPAM, tax and driver-licence filings

- Emergency OQTF and appeal representation

Book a free 15-minute eligibility call now at https://immifrance.com and start living the French country dream—legally and stress-free.